Thrifty Car Rental 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

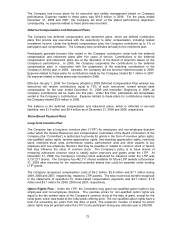

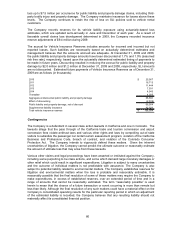

The Company recognized $2.7 million and $1.0 million in compensation costs (included in the $6.2

million and $3.9 million discussed above) during 2009 and 2008, respectively, related to the 2009

and 2008 stock option awards. No expense was recorded during 2007 because all previously

issued stock options were fully vested at January 1, 2007. The Black-Scholes option valuation

model was used to estimate the fair value of the options at the date of the grant. The assumptions

used to calculate compensation expense relating to the stock option awards granted during 2009

and 2008 were as follows:

2009 2008

Weighted-average expected life (in years) 5 5

Expected price volatility 80.24% 53.31%

Risk-free interest rate 2.36% 3.19%

Dividend payments 0 0

The weighted average grant-date fair value of options issued in 2009 and 2008 was $4.44 and

$7.58, respectively. The options issued in May 2009 vest in installments over three years with 20%

exercisable in each of 2010 and 2011 and the remaining 60% exercisable in 2012. The options

issued in October 2008 vest ratably over three years and the options issued in January 2008 vest at

the end of three years. Expense is recognized over the service period which is the vesting period.

Unrecognized expense remaining for the options at December 31, 2009 and 2008 was $3.0 million

and $2.9 million, respectively.

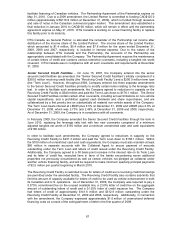

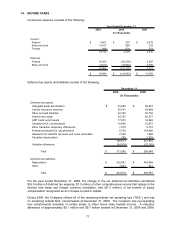

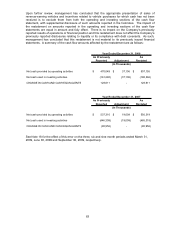

The following table sets forth the non-qualified option rights activity for non-qualified option rights

under the LTIP for the periods indicated:

Weighted

Weighted Average Aggregate

Number o

f

Average Remaining Intrinsic

Shares Exercise Contractual Value

(In Thousands) Price Term (In Thousands)

Outstanding at December 31, 2006 527 17.51$ 3.56 14,804$

Granted - -

Exercised (62) 17.67

Canceled - -

Outstanding at December 31, 2007 465 17.49 2.63 2,883

Granted 1,258 7.58

Exercised (3) 11.10

Canceled (118) 18.44

Outstanding at December 31, 2008 1,602 9.65 7.05 122

Granted 1,120 4.44

Exercised (137) 16.78

Canceled (134) 15.43

Outstanding at December 31, 2009 2,451 6.55$ 8.11 46,702$

Fully vested options at:

December 31, 2009 483 8.41$ 5.70 8,311$

Options expected to vest at:

December 31, 2009 1,968 6.10$ 9.01 38,391$

73