Thrifty Car Rental 2009 Annual Report Download - page 47

Download and view the complete annual report

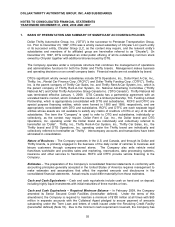

Please find page 47 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.New Accounting Standards

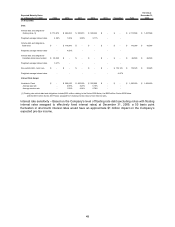

For a discussion on new accounting standards refer to Item 8 - Note 1 of Notes to Consolidated Financial

Statements.

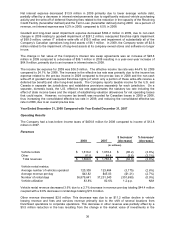

Outlook for 2010

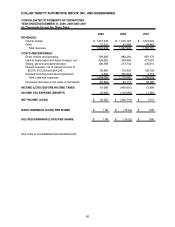

The Company expects industry conditions to improve slightly in 2010 as a result of several factors.

Continued improvement in the overall economy, combined with ongoing recovery in the credit markets, is

expected to result in low single-digit growth in transaction days in 2010. The Company believes that

customer demand for its value-oriented leisure brands and continued industry pricing discipline will result

in moderate price increases in revenue per day on a year-over-year basis. Finally, the Company believes

that recent favorable trends in the used vehicle markets will continue throughout 2010, resulting in solid

residual values and improvements in monthly fleet operating costs year over year.

Based on the above expectations, the Company is targeting Corporate Adjusted EBITDA for the full year

of 2010 to be within a range of $120 million to $140 million. The Company provided the following

additional information with respect to its full year guidance:

x Vehicle rental revenues are projected to be up 2 – 4 percent compared to 2009, resulting from

low single-digit increases in both transaction days and revenue per day.

x Vehicle depreciation costs for the full year of 2010 are expected to be approximately $325 per

vehicle per month. The Company noted that disposition of vehicles is expected to create some

volatility in the level of these costs on a quarter-to-quarter basis.

46