Thrifty Car Rental 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

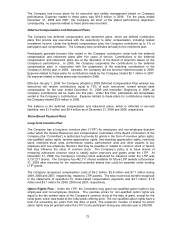

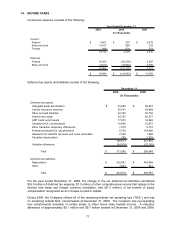

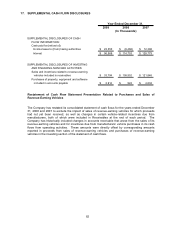

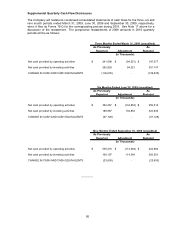

17. SUPPLEMENTAL CASH FLOW DISCLOSURES

2009 2008 2007

(In Thousands)

SUPPLEMENTAL DISCLOSURES OF CASH

FLOW INFORMATION:

Cash paid for/(refund of):

Income taxes to (from) taxing authorities 22,350$ (8,486)$ 12,396$

Interest 96,569$ 114,753$ 128,779$

SUPPLEMENTAL DISCLOSURES OF INVESTING

AND FINANCING NONCASH ACTIVITIES:

Sales and incentives related to revenue-earning

vehicles included in receivables 33,704$ 158,952$ 121,846$

Purchases of property, equipment and software

included in accounts payable 2,914$ 924$ 4,632$

Year Ended December 31,

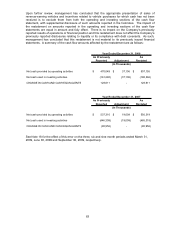

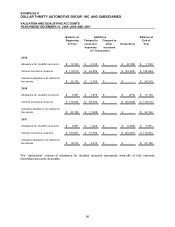

Restatement of Cash Flow Statement Presentation Related to Purchases and Sales of

Revenue-Earning Vehicles

The Company has restated its consolidated statement of cash flows for the years ended December

31, 2008 and 2007 to exclude the impact of sales of revenue-earning vehicles for which proceeds

had not yet been received, as well as changes in certain vehicle-related incentives due from

manufacturers, both of which were included in Receivables at the end of each period. The

Company has historically included changes in accounts receivable that arose from the sales of its

revenue-earning vehicles and for incentives due from manufacturers’ vehicle purchases in its cash

flows from operating activities. These amounts were directly offset by corresponding amounts

reported in proceeds from sales of revenue-earning vehicles and purchases of revenue-earning

vehicles in the investing section of the statement of cash flows.

82