Thrifty Car Rental 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additionally, during 2009, the Company amended its Senior Secured Credit Facilities, whereby the

Company may not increase the available amount of the letters of credit issued as enhancement for

the Company’s 2005 Series notes at any time prior to the occurrence of an event of bankruptcy with

respect to a Monoline under the 2005 Series notes if, at the time, the 2005 Series notes letter of

credit amount is greater than $24.4 million or if the requested increase would cause the Series

2005-1 letter of credit amount to exceed that amount, and whereby letters of credit to be issued as

enhancement for future fleet financing will be limited to a maximum of 7% of the initial face amount

of each series of asset backed medium term notes issued, up to the existing sub-limit under the

facility of $100 million. This amendment does not apply to, nor have any impact on, the Company’s

existing medium term notes and enhancement letters of credit.

During 2009, the Company paid $6.6 million in financing issue costs primarily related to various

amendments of its asset backed medium term notes and Senior Secured Credit Facilities.

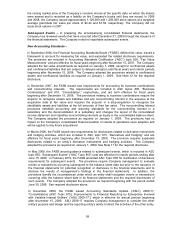

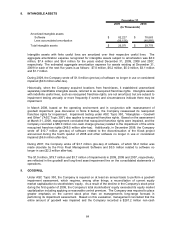

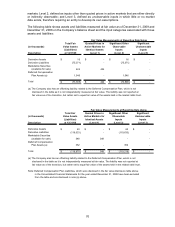

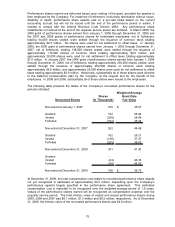

Expected maturities of debt and other obligations outstanding at December 31, 2009 are as follows:

2010 2011 2012 2013 2014 Thereafte

r

Asset backed medium term notes 500,000$ 500,000$ 500,000$ -$ -$ -$

69,690 - - - - -

Term Loan 10,000 10,000 10,000 128,125 - -

Total 579,690$ 510,000$ 510,000$ 128,125$ -$ -$

(In Thousands)

Limited partner interest (CAD fleet

financing)

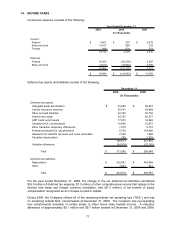

11. DERIVATIVE FINANCIAL INSTRUMENTS

The Company is exposed to market risks, such as changes in interest rates. Consequently, the

Company manages the financial exposure as part of its risk management program, by striving to

reduce the potentially adverse effects that the volatility of the financial markets may have on the

Company’s operating results. The Company has used interest rate swap agreements, for each

related new asset backed medium term note issuance in 2005 through 2007, to effectively convert

variable interest rates on a total of $1.4 billion in asset backed medium term notes to fixed interest

rates. These swaps have termination dates through July 2012. The fair value of derivatives

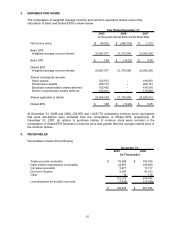

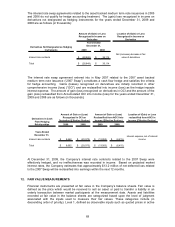

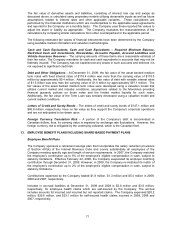

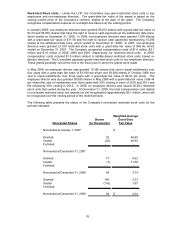

outstanding for the years ended December 31, 2009 and 2008 are as follows (in thousands):

Balance

Sheet

Location Fair Value

Balance

Sheet

Location Fair Value

Balance

Sheet

Location Fair Value

Balance

Sheet

Location Fair Value

Accrued Accrued

Interest rate contracts Receivables -$ Receivables -$ liabilities 40,639$ liabilities 56,069$

-$ -$ 40,639$ 56,069$

Accrued Accrued

Interest rate contracts Receivables 16$ Receivables 63$ liabilities 34,732$ liabilities 63,564$

16$ 63$ 34,732$ 63,564$

Total derivatives 16$ 63$ 75,371$ 119,633$

Fair Values of Derivative Instruments

Asset Derivatives Liability Derivatives

December 31, December 31, December 31, December 31,

2009 2008 2009 2008

Derivatives designated as hedging

instruments

Total derivatives designated as hedging

instruments

Derivatives not designated as hedging

instruments

Total derivatives not designated as hedging

instruments

68