Thrifty Car Rental 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

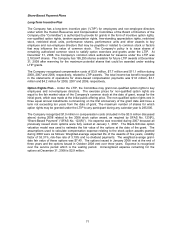

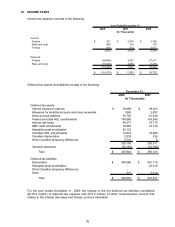

The Company has net operating loss carryforwards available in certain states to offset future state

taxable income. At December 31, 2008, the Company has federal net operating loss carryforwards

of approximately $280.0 million available to offset future taxable income in the U.S., which expire

beginning in 2023 through 2024. A valuation allowance of approximately $0.7 million and $2.8

million existed at December 31, 2008 and 2007, respectively, for state net operating losses. At

December 31, 2008, DTG Canada has net operating loss carryforwards of approximately $40.0

million available to offset future taxable income in Canada, which expire beginning in 2010 through

2028. Valuation allowances have been established for the total estimated future tax effect of the

Canadian net operating losses and other deferred tax assets.

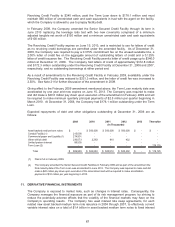

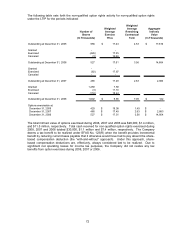

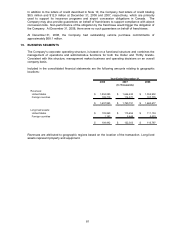

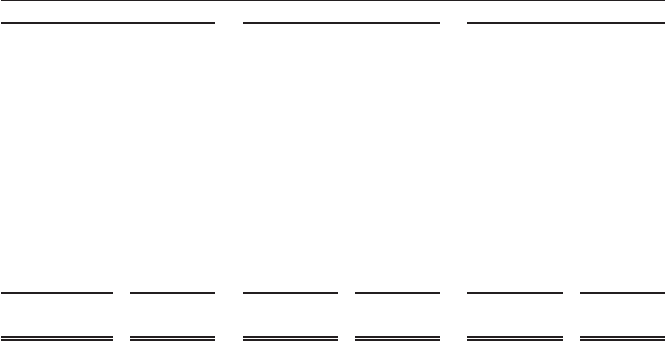

The Company’s effective tax rate differs from the maximum U.S. statutory income tax rate. The

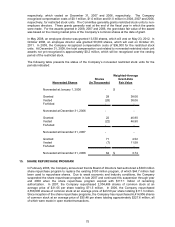

following summary reconciles taxes at the maximum U.S. statutory rate with recorded taxes:

Amount Percent

A

mount Percent Amount Percent

(Amounts in Thousands)

Tax expense computed at the

maximum U.S. statutory rate (159,880)$ 35.0% 4,483$ 35.0% 30,947$ 35.0%

Difference resulting from:

State and local taxes, net of

federal income tax benefit (12,117) 2.7% 3,130 24.4% 2,528 2.9%

Foreign losses 7,701 (1.7%) 3,617 28.2% 1,614 1.8%

Foreign taxes 588 (0.1%) 275 2.2% 1,345 1.5%

Nondeductible impairment 43,749 (9.6%) - 0.0% - 0.0%

Other 3,580 (0.8%) 88 0.7% 295 0.3%

Total (116,379)$ 25.5% 11,593$ 90.5% 36,729$ 41.5%

Year Ended December 31,

2008 2007 2006

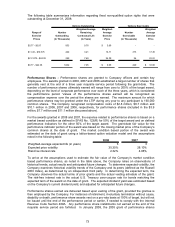

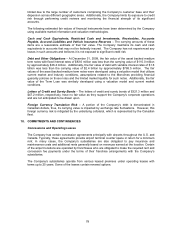

Effective January 1, 2007, the Company adopted the provisions of FIN No. 48. Upon adoption of

FIN No. 48 and as of December 31, 2008, the Company had no material liability for unrecognized

tax benefits and no material adjustments to the Company’s opening financial position were required.

There are no material tax positions for which it is reasonably possible that unrecognized tax benefits

will significantly change in the twelve months subsequent to December 31, 2008.

The Company files income tax returns in the U.S. federal and various state, local and foreign

jurisdictions. In the Company’s significant tax jurisdictions, the tax years 2005 through 2007 are

subject to examination by federal taxing authorities and the tax years 2003 through 2007 are subject

to examination by state and foreign taxing authorities.

The Company accrues interest and penalties on underpayment of income taxes related to

unrecognized tax benefits as a component of income tax expense in the consolidated statement of

operations. No amounts were recognized for interest and penalties upon adoption of FIN No. 48 or

during the year ended December 31, 2008.

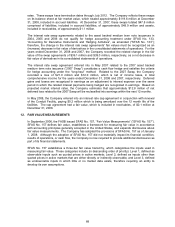

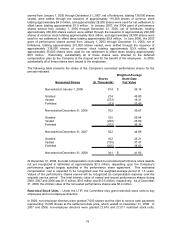

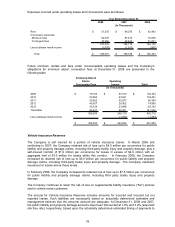

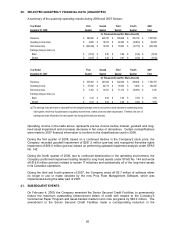

17. CONCENTRATION OF CREDIT RISK AND FAIR VALUE INFORMATION

Financial instruments which potentially subject the Company to concentrations of credit risk consist

principally of cash and cash equivalents, restricted cash and investments, interest rate swaps,

Chrysler and other vehicle manufacturer receivables and trade receivables. The Company limits its

exposure on cash and cash equivalents and restricted cash and investments by investing in Aaa or

P-1 rated funds and short-term time deposits with a diverse group of high quality financial

institutions. The Company’s exposure relating to interest rate swaps is mitigated by diversifying the

financial instruments among various counterparties, which consist of major financial institutions.

Receivables from Chrysler, the Company's primary vehicle supplier, and other vehicle

manufacturers consist primarily of amounts due under guaranteed residual, buyback, incentive and

promotion programs. The Company’s financial condition and results of operations would be

materially adversely affected if Chrysler or another vehicle manufacturer were unable to meet their

obligations to the Company. Concentrations of credit risk with respect to trade receivables are

77