Thrifty Car Rental 2008 Annual Report Download - page 73

Download and view the complete annual report

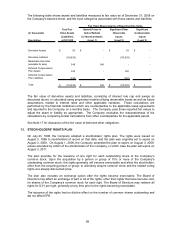

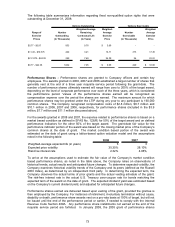

Please find page 73 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Share-Based Payment Plans

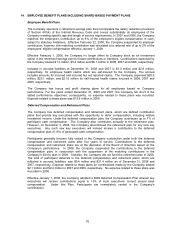

Long-Term Incentive Plan

The Company has a long-term incentive plan (“LTIP”) for employees and non-employee directors

under which the Human Resources and Compensation Committee of the Board of Directors of the

Company (the “Committee”) is authorized to provide for grants in the form of incentive option rights,

non-qualified option rights, tandem appreciation rights, free-standing appreciation rights, restricted

stock, restricted stock units, performance shares, performance units and other awards to key

employee and non-employee directors that may be payable or related to common stock or factors

that may influence the value of common stock. The Company’s policy is to issue shares of

remaining authorized common stock to satisfy option exercises and grants under the LTIP. At

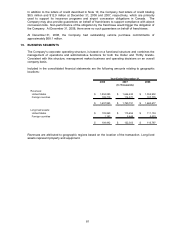

December 31, 2008, the Company’s common stock authorized for issuance under the LTIP was

2,183,647 shares. The Company has 195,295 shares available for future LTIP awards at December

31, 2008 after reserving for the maximum potential shares that could be awarded under existing

LTIP grants.

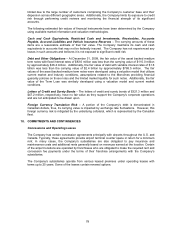

The Company recognized compensation costs of $3.9 million, $7.7 million and $11.1 million during

2008, 2007 and 2006, respectively, related to LTIP awards. The total income tax benefit recognized

in the statements of operations for share-based compensation payments was $1.6 million, $3.1

million and $4.2 million for 2008, 2007 and 2006, respectively.

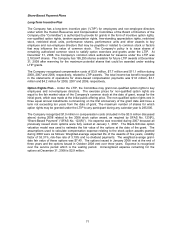

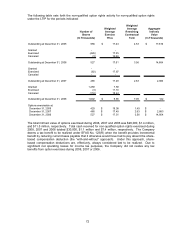

Option Rights Plan – Under the LTIP, the Committee may grant non-qualified option rights to key

employees and non-employee directors. The exercise prices for non-qualified option rights are

equal to the fair market value of the Company’s common stock at the date of grant, except for the

initial grant, which was made at the initial public offering price. The non-qualified option rights vest in

three equal annual installments commencing on the first anniversary of the grant date and have a

term not exceeding ten years from the date of grant. The maximum number of shares for which

option rights may be granted under the LTIP to any participant during any calendar year is 285,000.

The Company recognized $1.0 million in compensation costs (included in the $3.9 million discussed

above) during 2008 related to the 2008 stock option award, as required by SFAS No. 123(R),

“Share-Based Payment” (“SFAS No. 123(R)”). No expense was recorded during 2007 because all

previously issued stock options were fully vested at January 1, 2007. The Black-Scholes option

valuation model was used to estimate the fair value of the options at the date of the grant. The

assumptions used to calculate compensation expense relating to the stock option awards granted

during 2008 were as follows: Weighted-average expected life of the awards of five years, volatility

factor of 53.31%, risk-free rate of 3.19% and no dividend payments. The weighted average grant-

date fair value of these options was $7.40. The options issued in January 2008 vest at the end of

three years and the options issued in October 2008 vest over three years. Expense is recognized

over the service period which is the vesting period. Unrecognized expense remaining for the

options at December 31, 2008 is $2.9 million.

71