Thrifty Car Rental 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

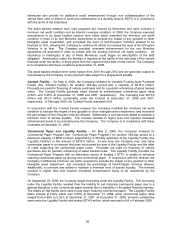

Revolving Credit Facility to $340 million, paid the Term Loan down to $178.1 million and must

maintain $60 million of unrestricted cash and cash equivalents in trust with the agent on the facility,

which the Company is allowed to use to prepay facility debt.

In February 2009, the Company amended the Senior Secured Credit Facility through its term in

June 2013 replacing the leverage ratio test with two new covenants comprised of a minimum

adjusted tangible net worth of $150 million and a minimum unrestricted cash and cash equivalents

of $100 million.

The Revolving Credit Facility expires on June 15, 2013, and is restricted to use for letters of credit

as no revolving credit borrowings are permitted under the amended facility. As of December 31,

2008, the Company was required to pay a 0.375% commitment fee on the unused available line, a

2.00% letter of credit fee on the aggregate amount of outstanding letters of credit and a 0.125%

letter of credit issuance fee. The Revolving Credit Facility permits letter of credit usage up to $340.0

million at December 31, 2008. The Company had letters of credit of approximately $312.8 million

and $172.3 million outstanding under the Revolving Credit Facility at December 31, 2008 and 2007,

respectively, and no outstanding borrowings at either period end.

As a result of amendments to the Revolving Credit Facility in February 2009, availability under the

Revolving Credit Facility was reduced to $231.3 million, and the letter of credit fee was increased to

2.50%. See Note 21 for further discussion of the amendment in 2009.

Giving effect to the February 2009 amendment mentioned above, the Term Loan maturity date was

accelerated by one year and now expires on June 15, 2013. The Company was required to make

and did make a $20.0 million pay down upon execution of the amendment in February 2009 and will

be required to make minimum quarterly principal payments of $2.5 million per quarter beginning in

March 2010. At December 31, 2008, the Company had $178.1 million outstanding under the Term

Loan.

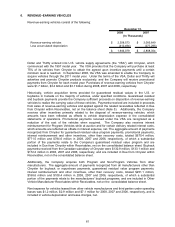

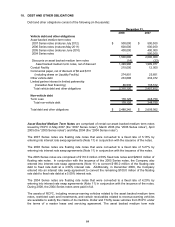

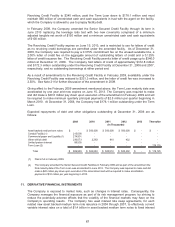

Expected repayments of debt and other obligations outstanding at December 31, 2008 are as

follows:

2009 2010 2011 2012 2013 Thereafter

Asset backed medium term notes -$ 500,000$ 500,000$ 500,000$ -$ -$

Conduit Facility (1) 215,000 - - - - -

Commercial paper and Liquidity (1) 274,901 - - - - -

Other vehicle debt 230,073 2,283 910 432 - -

Limited partner interest 86,535 - - - - -

Term Loan (2) - - - - - 178,125

Total 806,509$ 502,283$ 500,910$ 500,432$ -$ 178,125$

(1) Paid in full in February 2009.

(2) The Company amended the Senior Secured Credit Facilities in February 2009 and as part of the amendment the

final maturity date of the Term Loan was accelerated to June 2013. The Company was required to make and did

make a $20 million pay down upon execution of the amendment and will be required to make amortization

payments of $10 million per year beginning in 2010.

(In Thousands)

11. DERIVATIVE FINANCIAL INSTRUMENTS

The Company is exposed to market risks, such as changes in interest rates. Consequently, the

Company manages the financial exposure as part of its risk management program, by striving to

reduce the potentially adverse effects that the volatility of the financial markets may have on the

Company’s operating results. The Company has used interest rate swap agreements, for each

related new asset backed medium term note issuance in 2004 through 2007, to effectively convert

variable interest rates on a total of $1.4 billion in asset backed medium term notes to fixed interest

67