Thrifty Car Rental 2008 Annual Report Download - page 56

Download and view the complete annual report

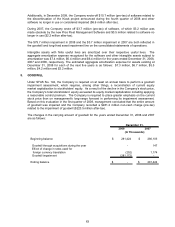

Please find page 56 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.indenture. Restricted cash and investments are excluded from cash and cash equivalents. Interest

earned on restricted cash and investments was $8.9 million, $14.0 million and $16.9 million, for

2008, 2007 and 2006, respectively, and remains in restricted cash and investments.

Allowance for Doubtful Accounts – An allowance for doubtful accounts is generally established

during the period in which receivables are recorded. The allowance is maintained at a level deemed

appropriate based on loss experience and other factors affecting collectibility.

Financing Issue Costs – Financing issue costs related to vehicle debt and the Senior Secured

Credit Facilities are deferred and amortized to interest expense over the term of the related debt

using the effective interest method.

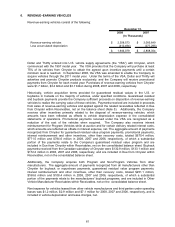

Revenue-Earning Vehicles and Related Vehicle Depreciation Expense – Revenue earning

vehicles are stated at cost, net of related discounts. The Company has historically purchased 50%

to 60% of its vehicles for which residual values are determined by depreciation rates that are

established and guaranteed by the manufacturers (“Program Vehicles”) with the remaining 40% to

50% of the Company’s vehicles purchased without the benefit of a manufacturer residual value

guaranty program (“Non-Program Vehicles”). However in 2008, the Company has been increasing

the level of Non-Program Vehicles in its fleet. At December 31, 2008, Non-Program Vehicles

accounted for approximately 75% of the total fleet.

For these Non-Program Vehicles, the Company must estimate what the residual values of these

vehicles will be at the expected time of disposal to determine monthly depreciation rates. The

estimation of residual values requires the Company to make assumptions regarding the age and

mileage of the car at the time of disposal, as well as the general used vehicle auction market. The

Company evaluates estimated residual values monthly. Differences between actual residual values

and those estimated by the Company result in a gain or loss on disposal and are recorded as an

adjustment to depreciation expense. Actual timing of disposal shorter than the life used for

depreciation purposes could result in a significant loss on sale. For 2008, the average holding term

for Non-Program Vehicles was approximately ten months and for Program Vehicles was

approximately six months.

For Program Vehicles, the Company is required to depreciate the vehicle according to the terms of

the guaranteed depreciation or repurchase program and in doing so is guaranteed to receive the full

net book value in proceeds upon the sale of the vehicle. The sales proceeds are received directly

from auctions, in the case of the Chrysler program, with any shortfall in value being paid by Chrysler.

With certain other vehicle manufacturers, the entire balance of proceeds from vehicle sales comes

directly from the manufacturer. In either case, the Company bears the risk of collectibility on that

receivable from the vehicle manufacturer. The Company monitors its vehicle manufacturer

receivables based on time outstanding, manufacturer strength and length of the relationship.

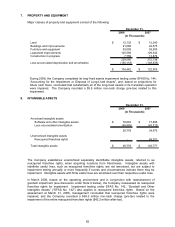

Property and Equipment – Property and equipment are recorded at cost and are depreciated or

amortized using principally the straight-line method over the estimated useful lives of the related

assets. Estimated useful lives range from ten to thirty years for buildings and improvements and

three to seven years for furniture and equipment. Leasehold improvements are amortized over the

estimated useful lives of the related assets or leases, whichever is shorter.

Intangible Assets – Software and other intangible assets are recorded at cost and amortized using

the straight-line method primarily over five years. The remaining useful life of all intangible assets is

evaluated annually to assess whether events and circumstances warrant a revision to the remaining

amortization period.

Reacquired franchise rights, established upon reacquiring a previously franchised location, are not

amortized as they have an indefinite life, rather they are tested annually for impairment in

accordance with Emerging Issues Task Force ("EITF") No. 04-1, "Accounting for Preexisting

Relationships between the Parties to a Business Combination" ("EITF No. 04-1") (Note 8).

54