Thrifty Car Rental 2008 Annual Report Download - page 70

Download and view the complete annual report

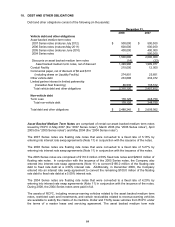

Please find page 70 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rates. These swaps have termination dates through July 2012. The Company reflects these swaps

on its balance sheet at fair market value, which totaled approximately $119.6 million at December

31, 2008, included in accrued liabilities. At December 31, 2007, these swaps totaled $47.8 million

comprised of liabilities, included in accrued liabilities, of approximately $48.9 million and assets,

included in receivables, of approximately $1.1 million.

The interest rate swap agreements related to the asset backed medium term note issuances in

2004, 2005 and 2006 do not qualify for hedge accounting treatment under SFAS No. 133,

“Accounting for Derivative Instruments and Hedging Activities”, as amended (“SFAS No. 133”);

therefore, the change in the interest rate swap agreements’ fair values must be recognized as an

(increase) decrease in fair value of derivatives in the consolidated statements of operations. For the

years ended December 31, 2008 and 2007, the Company recorded the related change in the fair

value of the swap agreements of $36.1 million and $39.0 million, respectively, as a net decrease in

fair value of derivatives in its consolidated statements of operations.

The interest rate swap agreement entered into in May 2007 related to the 2007 asset backed

medium term note issuance (“2007 Swap”) constitutes a cash flow hedge and satisfies the criteria

for hedge accounting under the “long-haul” method. Related to the 2007 Swap, the Company

recorded a loss of $21.0 million and $12.0 million, which is net of income taxes, in total

comprehensive income for the years ended December 31, 2008 and 2007, respectively. Deferred

gains and losses are recognized in earnings as an adjustment to interest expense over the same

period in which the related interest payments being hedged are recognized in earnings. Based on

projected market interest rates, the Company estimates that approximately $12.8 million of net

deferred loss related to the 2007 Swap will be reclassified into earnings within the next 12 months.

In May 2008, the Company entered into an interest rate cap agreement in conjunction with renewal

of the Conduit Facility, paying $0.2 million which is being amortized over the 12 month life of the

facilities. The cap agreement had a fair value, which is included in receivables, of $0.1 million at

December 31, 2008.

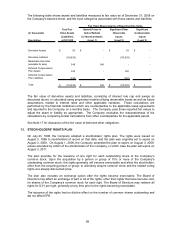

12. FAIR VALUE MEASUREMENTS

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS No. 157”).

SFAS No. 157 defines fair value, establishes a framework for measuring fair value in accordance

with accounting principles generally accepted in the United States, and expands disclosures about

fair value measurements. The Company has adopted the provisions of SFAS No. 157 as of January

1, 2008. Although the adoption of SFAS No. 157 did not materially impact its financial condition,

results of operations, or cash flow, the Company is now required to provide additional disclosures as

part of its financial statements.

SFAS No. 157 establishes a three-tier fair value hierarchy, which categorizes the inputs used in

measuring fair value. These categories include (in descending order of priority): Level 1, defined as

observable inputs such as quoted prices in active markets; Level 2, defined as inputs other than

quoted prices in active markets that are either directly or indirectly observable; and Level 3, defined

as unobservable inputs in which little or no market data exists, therefore requiring an entity to

develop its own assumptions.

68