Thrifty Car Rental 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Obligations), the Company will pay down existing borrowings under these lines of credit over the normal

amortization period as vehicles financed are sold. The asset backed medium term note program is

comprised of $1.5 billion in asset backed medium term notes with maturities ranging from 2010 to 2012.

Cash used in financing activities was $182.0 million for 2007 primarily due to a decrease of $413.0 million

under the Conduit Facility, the maturity of asset backed medium term notes totaling $312.5 million, a net

decrease in the issuance of commercial paper totaling $153.1 million and share repurchases totaling

$71.5 million. Cash used in financing activities was partially offset by the issuance of $500 million in

asset backed medium term notes in May 2007, the proceeds of the $250 million Term Loan in June 2007,

and an increase of $42.1 million in other existing bank vehicle lines of credit.

Cash used in financing activities was $91.9 million for 2006 primarily due to a net decrease in the

issuance of commercial paper totaling $382.2 million, the maturity of asset backed notes totaling $295.8

million and share repurchases totaling $111.3 million, partially offset by the issuance of $600.0 million in

asset backed notes in March 2006, an increase of $50.0 million under the Conduit Facility, and an

increase of $47.4 million in other existing bank vehicle lines of credit.

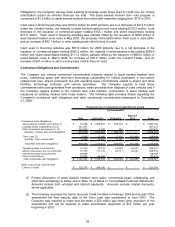

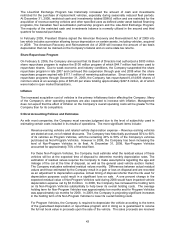

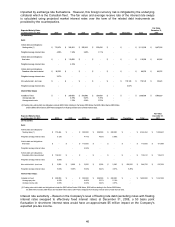

Contractual Obligations and Commitments

The Company has various contractual commitments primarily related to asset backed medium term

notes, commercial paper and short-term borrowings outstanding for vehicle purchases, a non-vehicle

related term loan, airport concession fee and operating lease commitments related to airport and other

facilities, technology contracts, and vehicle purchases. The Company expects to fund these

commitments with cash generated from operations, sales proceeds from disposal of used vehicles and if

the Company regains access to the medium term note markets, continuation of asset backed note

issuances as existing medium term notes mature. The following table provides details regarding the

Company’s contractual cash obligations and other commercial commitments subsequent to December

31, 2008:

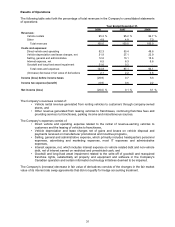

Beyond

2009 2010-2011 2012-2013 2013 Total

Contractual cash obligations:

Asset backed medium term notes (1) 76,248$ 1,094,578$ 509,312$ -$ 1,680,138$

Liquidity facility outstanding (1) (3) 281,331 - - - 281,331

Other short-term borrowings (1) (4) 543,950 3,409 456 - 547,815

Subtotal - Vehicle debt and obligations 901,529 1,097,987 509,768 - 2,509,284

Term Loan (2) 5,089 13,940 17,157 182,458 218,644

Subtotal - Non-vehicle debt 5,089 13,940 17,157 182,458 218,644

Total debt and other obligations 906,618 1,111,927 526,925 182,458 2,727,928

Operating lease commitments 57,010 79,718 53,360 56,091 246,179

Airport concession fee commitments 75,153 111,172 84,771 85,437 356,533

Vehicle purchase commitments 68,089 - - - 68,089

Other commitments 33,832 46,486 - - 80,318

Total contractual cash obligations 1,140,702$ 1,349,303$ 665,056$ 323,986$ 3,479,047$

Other commercial commitments:

Letters of credit 122,574$ 198,700$ -$ -$ 321,274$

Payments due or commitment expiration by period

(in thousands)

(1) Further discussion of asset backed medium term notes, commercial paper outstanding and

short-term borrowings is below and in Note 10 of Notes to Consolidated Financial Statements.

Amounts include both principal and interest payments. Amounts exclude related discounts,

where applicable.

(2) The Company amended the Senior Secured Credit Facilities in February 2009 and as part of the

amendment the final maturity date of the Term Loan was accelerated to June 2013. The

Company was required to make and did make a $20 million pay down upon execution of the

amendment and will be required to make amortization payments of $10 million per year

beginning in 2010.

39