Thrifty Car Rental 2008 Annual Report Download - page 72

Download and view the complete annual report

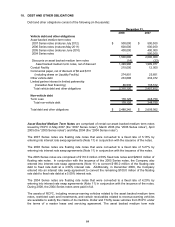

Please find page 72 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14. EMPLOYEE BENEFIT PLANS INCLUDING SHARE-BASED PAYMENT PLANS

Employee Benefit Plans

The Company sponsors a retirement savings plan that incorporates the salary reduction provisions

of Section 401(k) of the Internal Revenue Code and covers substantially all employees of the

Company meeting specific age and length of service requirements. In 2007 and 2006, the Company

matched the employee’s contribution up to 6% of the employee’s eligible compensation in cash,

subject to statutory limitations. Effective February 22, 2008, the Company suspended its employer

contribution; however, this matching contribution was reinstated at a reduced rate of up to 2% of the

employees’ eligible compensation effective January 1, 2009.

Effective February 1, 2006, the Company no longer offers its Company stock as an investment

option in the retirement savings plan for future contributions or transfers. Contributions expensed by

the Company totaled $1.3 million, $5.4 million and $6.1 million in 2008, 2007 and 2006, respectively.

Included in accrued liabilities at December 31, 2008 and 2007 is $3.0 million and $2.8 million,

respectively, for employee health claims which are self-insured by the Company. The accrual

includes amounts for incurred and incurred but not reported claims. The Company expensed $20.6

million, $23.1 million, and $21.0 million for self-insured health claims incurred in 2008, 2007 and

2006, respectively.

The Company has bonus and profit sharing plans for all employees based on Company

performance. For the years ended December 31, 2008 and 2007, the Company fell short of the

stated performance objectives; consequently, no expense related to these plans was recorded.

Expense related to these plans was $13.6 million in 2006.

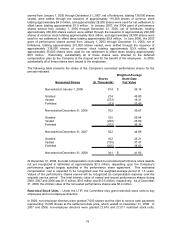

Deferred Compensation and Retirement Plans

The Company has deferred compensation and retirement plans, which are defined contribution

plans that provide key executives with the opportunity to defer compensation, including related

investment income. Under the deferred compensation plan, the Company contributes up to 7% of

participant cash compensation. The Company also contributes annually to the retirement plan.

However, on December 2, 2004, the Company discontinued the retirement plan for any new key

executives. Any such new key executives will instead receive a contribution to the deferred

compensation plan of 15% of participant cash compensation.

Participants generally become fully vested in the Company contribution under both the deferred

compensation and retirement plans after five years of service. Contributions to the deferred

compensation and retirement plans are at the discretion of the Board of Directors based on the

Company’s performance. In 2008, the Company suspended the contributions to the deferred

compensation plan, in conjunction with the suspension of the matching contributions in the

Company’s 401(k) plan in 2008. Likewise, the Company did not fund the retirement plan in 2008.

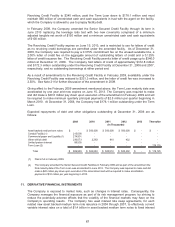

The total of participant deferrals in the deferred compensation and retirement plans, which are

reflected in accrued liabilities, was $0.4 million and $21.4 million as of December 31, 2008 and

2007, respectively. Expense related to these plans for contributions made by the Company totaled

$2.1 million and $2.4 million in 2007 and 2006, respectively. No expense related to these plans was

recorded in 2008.

Effective January 1, 2009, the Company adopted a 2009 Deferred Compensation Plan wherein key

executives will receive contributions equal to 15% of such executives’ current annual base

compensation. Under this Plan, Participants are immediately vested in the Company’s

contributions.

70