Thrifty Car Rental 2008 Annual Report Download - page 67

Download and view the complete annual report

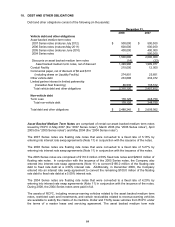

Please find page 67 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.indentures also provide for additional credit enhancement through over collateralization of the

vehicle fleet, cash or letters of credit and maintenance of a liquidity reserve. RCFC is in compliance

with the terms of the indentures.

The asset backed medium term note programs are insured by Monolines and each contains a

minimum net worth condition and an interest coverage condition. In 2008, the Company executed

amendments to its asset backed medium term notes which amended the minimum net worth

condition in three of its four Monoline agreements to exclude the impact of any goodwill or other

intangible asset impairment, and increased the level of Non-Program Vehicles allowed to be

financed to 75%, allowing the Company to continue its efforts to increase the level of Non-Program

Vehicles in its fleet. The Company provided increased enhancement for the one Monoline

agreement not amended in order to comply with the existing minimum net worth condition. An

insolvency or bankruptcy of any of these Monolines could trigger an amortization of the debt

obligation. Amortization under the facilities is required at the earlier of the sale date of the vehicle

financed under the facility, or three years from the original invoice date of that vehicle. The Company

is in compliance with these conditions at December 31, 2008.

The asset backed medium term notes mature from 2010 through 2012 and are generally subject to

repurchase by the Company on any payment date subject to a prepayment penalty.

Conduit Facility – On May 8, 2008, the Company renewed its Variable Funding Note Purchase

Facility (the “Conduit Facility”) for another 364-day period with a capacity of $215.0 million.

Proceeds are used for financing of vehicle purchases and for a periodic refinancing of asset backed

notes. The Conduit Facility generally bears interest at market-based commercial paper rates

(4.62% and 5.86% at December 31, 2008 and 2007, respectively). The Company had $215.0

million and $12.0 million outstanding under the Conduit at December 31, 2008 and 2007,

respectively. In February 2009, the Conduit Facility was paid in full.

In conjunction with the Conduit Facility renewal, the Company modified the minimum net worth

condition to exclude the impact of any goodwill or other intangible asset impairment, and increased

the percentage of Non-Program Vehicles allowed. Additionally, a covenant was added to maintain a

minimum level of excess liquidity. The renewal resulted in higher fees and requires increased

enhancement levels to be maintained by the Company. The Company is in compliance with these

covenants at December 31, 2008.

Commercial Paper and Liquidity Facility – On May 8, 2008, the Company renewed its

Commercial Paper Program (the “Commercial Paper Program”) for another 364-day period at a

maximum capacity of $800.0 million supported by a 364-day extension of the Liquidity Facility (the

“Liquidity Facility”) in the amount of $278.0 million. At any time, the Company may only issue

commercial paper in an amount that does not exceed the sum of the Liquidity Facility and the letter

of credit supporting the commercial paper notes. Proceeds are used for financing of vehicle

purchases and for periodic refinancing of asset backed notes. The Liquidity Facility provides the

Commercial Paper Program with an alternative source of funding if DTFC is unable to refinance

maturing commercial paper by issuing new commercial paper. In conjunction with this renewal, the

Company modified the minimum net worth covenant to exclude the impact of any goodwill or other

intangible asset impairment, and increased the percentage of Non-Program Vehicles allowed.

Additionally, a covenant was added to maintain a minimum level of excess liquidity. The renewal

resulted in higher fees and requires increased enhancement levels to be maintained by the

Company.

On September 23, 2008, the Company began borrowing under the Liquidity Facility. This borrowing

under the Liquidity Facility resulted from the inability to sell maturing commercial paper due to a

general disruption in the commercial paper markets due to instability in the global financial markets.

The draws on this facility were used to pay down maturing commercial paper. The Liquidity Facility

bears interest at prime which was 3.25% at December 31, 2008, while commercial paper rates

ranged from 4.95% to 5.32% at December 31, 2007. At December 31, 2008, amounts outstanding

were under the Liquidity Facility and totaled $274.9 million, which was paid in full in February 2009.

65