Thrifty Car Rental 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On September 23, 2008, the Company began borrowing under the Liquidity Facility. This borrowing

under the Liquidity Facility resulted from the inability to sell maturing commercial paper due to a general

disruption in the commercial paper markets as a result of instability in the global financial markets. The

draws on this facility were used to pay down maturing commercial paper. The Liquidity Facility bears

interest at prime which was 3.25% at December 31, 2008. At December 31, 2008, all amounts

outstanding were under the Liquidity Facility and totaled $274.9 million. The Commercial Paper Program

and Liquidity Facility contain minimum net worth covenants and an interest covenant. The Company is in

compliance with all covenants at December 31, 2008.

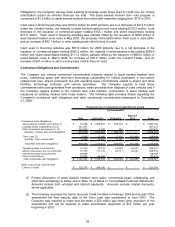

Other Vehicle Debt and Obligations

The Company finances its Canadian vehicle fleet through a fleet securitization program. Historically, this

program provided DTG Canada vehicle financing up to CND$300 million funded through a bank

commercial paper conduit which expires May 31, 2010. However, in October 2008, the committed

funding was reduced from CND$300 million to CND$200 million through the final maturity of the program.

At December 31, 2008, DTG Canada had approximately CND$105.3 million (US$86.5 million) funded

under this program. The Canadian fleet securitization program contains a tangible net worth covenant

and DTG Canada was in compliance with this covenant at December 31, 2008.

Vehicle manufacturer and bank lines of credit provided $233.7 million in capacity and borrowings at

December 31, 2008. Due to non-renewal of the vehicle manufacturer and bank lines of credit, the

Company will pay down existing borrowings over the normal amortization period as vehicles financed are

sold. Substantially all borrowings under the vehicle manufacturer and bank lines of credit must be repaid

by January 2010 and September 2009, respectively. These lines of credit are secured by the vehicles

financed under these facilities and contain a leverage ratio covenant which requires that the Company’s

corporate debt to corporate EBITDA be maintained within certain limits as defined in the respective

agreements. In February 2009, the Company amended these lines of credit. After giving effect to all

amendments, the Company was in compliance with this covenant at December 31, 2008.

Senior Secured Credit Facilities

At December 31, 2008, the Company’s Senior Secured Credit Facilities were comprised of a $340 million

Revolving Credit Facility and a $178.1 million Term Loan. The Senior Secured Credit Facilities contain

certain financial and other covenants, including a covenant that sets the maximum amount the Company

can spend annually on the acquisition of non-vehicle capital assets, a maximum leverage ratio and a

limitation on cash dividends and share repurchases, and are collateralized by a first priority lien on

substantially all material non-vehicle assets of the Company. The Senior Secured Credit Facilities were

amended effective November 24, 2008, effectively providing for a waiver of the leverage ratio covenant

through February 28, 2009, restricting the Company’s ability to borrow under the Revolving Credit Facility,

and requiring maintenance of at least $60 million of unrestricted cash and cash equivalents, among other

restrictions. After giving effect to the amendment, the Company was in compliance with all covenants.

Effective February 25, 2009, the Senior Secured Credit Facilities were further amended to replace the

leverage ratio covenant with requirements to maintain a minimum adjusted tangible net worth of $150

million and a minimum of $100 million of unrestricted cash and cash equivalents. In addition, the

amendment provides that Revolving Credit Facility commitments will be restricted to issuance of letters of

credit in future periods.

The Revolving Credit Facility expires on June 15, 2013 and is restricted to use for letters of credit as no

revolving credit borrowings are permitted under the amended facility. The Revolving Credit Facility

permitted letter of credit usage up to $340.0 million at December 31, 2008. The Company had letters of

credit outstanding under the Revolving Credit Facility of approximately $312.8 million and no working

capital borrowings at December 31, 2008.

As a result of amendments to the Revolving Credit Facility in February 2009, availability under the

Revolving Credit Facility was reduced from $340.0 million to $231.3 million.

Giving effect to the February 2009 amendment mentioned above, the Term Loan maturity date was

accelerated by one year and now expires on June 15, 2013. The Company was required to make and did

make a $20.0 million pay down upon execution of the amendment in February 2009 and will be required

to make minimum quarterly principal payments of $2.5 million per quarter beginning in March 2010. At

41