Thrifty Car Rental 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

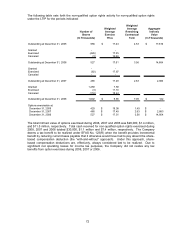

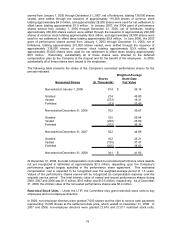

respectively, which vested on December 31, 2007 and 2006, respectively. The Company

recognized compensation costs of $0.1 million, $1.0 million and $1.0 million in 2008, 2007 and 2006,

respectively, for restricted stock units. The Committee generally grants restricted stock units to non-

employee directors. These grants generally vest at the end of the fiscal year in which the grants

were made. For the awards granted in 2008, 2007 and 2006, the grant-date fair value of the award

was based on the closing market price of the Company’s common shares at the date of grant.

In May 2008, an employee director was granted 13,550 shares, which will vest on May 23, 2012. In

October 2008, an employee director was granted 50,000 shares, which will vest on October 23,

2011. In 2008, the Company recognized compensation costs of $36,000 for the restricted stock

units. At December 31, 2008, the total compensation cost related to nonvested restricted stock unit

awards not yet recognized is approximately $0.2 million, which will be recognized over the vesting

period of the restricted stock.

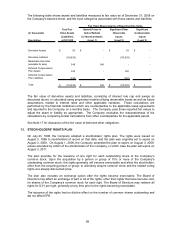

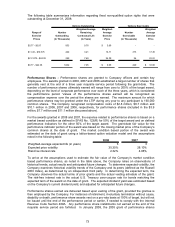

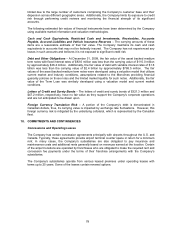

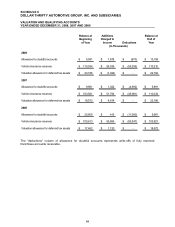

The following table presents the status of the Company’s nonvested restricted stock units for the

periods indicated:

Weighted-Average

Shares Grant-Date

Nonvested Shares (In Thousands) Fair Value

Nonvested at January 1, 2006 - -$

Granted 28 38.06

Vested (28) 38.06

Forfeited - -

Nonvested at December 31, 2006 - -

Granted 22 46.90

Vested (22) 46.90

Forfeited - -

Nonvested at December 31, 2007 - -

Granted 71 4.52

Vested (7) 11.58

Forfeited - -

Nonvested at December 31, 2008 64 3.74$

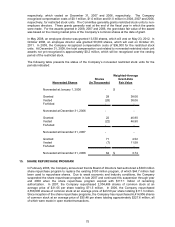

15. SHARE REPURCHASE PROGRAM

In February 2006, the Company announced that its Board of Directors had authorized a $300 million

share repurchase program to replace the existing $100 million program, of which $44.7 million had

been used to repurchase shares. Due to weak economic and industry conditions, the Company

suspended the share repurchase program in late 2007 and continued this suspension through year

end 2008 when the share repurchase program expired with $117.1 million of remaining

authorization. In 2007, the Company repurchased 2,304,406 shares of common stock at an

average price of $31.05 per share totaling $71.5 million. In 2006, the Company repurchased

2,558,900 shares of common stock at an average price of $43.50 per share totaling $111.3 million.

Since inception of the share repurchase programs, the Company has repurchased 6,414,906 shares

of common stock at an average price of $35.48 per share totaling approximately $227.6 million, all

of which were made in open market transactions.

75