Thrifty Car Rental 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

beginning of the performance period. At the end of each reporting period, the Company must

estimate whether the performance conditions will be achieved in order to determine the value of

the performance shares awarded. In making this determination, the Company has observed

actual past performance of the Company.

New Accounting Standards

For a discussion on new accounting standards refer to Note 1 of the Notes to Consolidated Financial

Statements.

Outlook for 2009 and Management’s Plans

The Company expects 2009 will continue to be a difficult operating environment as uncertainty

surrounding the timing of the U.S. economic recovery will continue to weigh on consumer confidence. At

the same time, challenges with automotive manufacturers, financial markets and used vehicle auctions

are expected to continue to impact fleet capacity and possibly fleet costs. The Company expects the

operating environment to remain challenging throughout 2009.

In 2009, the Company’s primary objective is preservation of liquidity and enhancement of operating cash

flow to ensure that it maintains maximum flexibility to address the uncertainties ahead. The Company

has taken the following steps to meet its objectives:

• completed significant personnel reductions to lower operating costs,

• extended fleet holding periods to lower vehicle depreciation expense,

• reduced overall fleet size in light of current and anticipated demand levels,

• closed certain marginal and non-profitable locations,

• entered into a multi-year secondary supply agreement with Ford to provide an alternative source

of vehicles to meet our customer needs, and

• obtained approval from our financing sources to maintain a fleet of 100% Non-Program Vehicles,

thus reducing credit exposure to automobile manufacturers for residual value guarantees, and

instituted new revenue management initiatives to enhance revenue.

In February 2009, the Company amended the Senior Secured Credit Facilities and two of its vehicle

financing agreements to replace the leverage ratio requirement with covenants to maintain a minimum

tangible net worth and a minimum level of cash and cash equivalents. By amending the Senior Secured

Credit Facilities through the maturity date and eliminating the uncertainty associated with short-term

amendments, senior management will be able to focus all of its efforts on improving operations,

maximizing cash flow and preserving liquidity, rather than focusing on short-term liquidity and covenant

issues.

The Company believes that its peak vehicle financing purchases for 2009 may be constrained as a result

of lack of bank credit capacity to replace the Conduit and Liquidity Facilities that expire in May 2009. The

Company will try to mitigate the impact of reduced credit availability by extending the holding period for its

Non-Program Vehicles. The Company has no maturities of asset backed medium term notes until 2010.

Fleet capacity for the rental car industry is expected to be in line with consumer demand in 2009. Year

over year, rental pricing trends improved in January 2009, offsetting a single digit decline in rental days.

See “Chrysler Restructuring or Bankruptcy” and “Bond Insurer Insolvency or Bankruptcy” risk factors in

Item 1A and Note 2 of Notes to Consolidated Financial Statements for additional discussion regarding

outlook for 2009 and management’s plans.

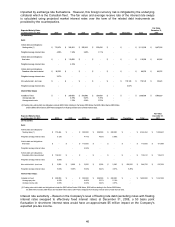

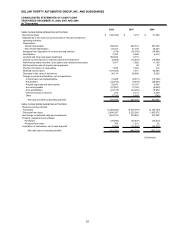

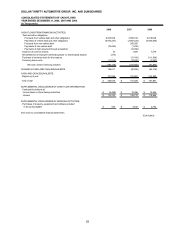

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The table below provides information about the Company’s market sensitive financial instruments and

constitutes a “forward-looking statement.” The Company’s primary market risk exposure is volatility of

interest rates, primarily in the United States. The Company manages interest rates through use of a

combination of fixed and floating rate debt and interest rate swap agreements (see Note 11 of Notes to

Consolidated Financial Statements). All items described are non-trading and are stated in U.S. dollars.

Because a portion of the Company’s debt is denominated in Canadian dollars, its carrying value is

45