Thrifty Car Rental 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

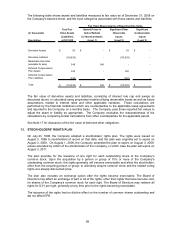

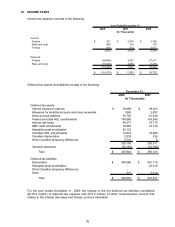

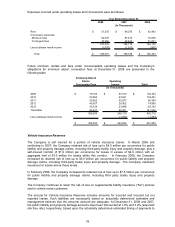

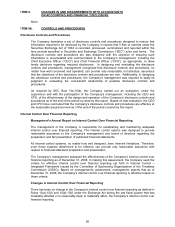

16. INCOME TAXES

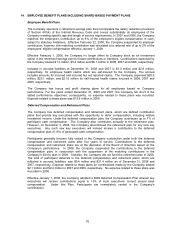

Income tax expense consists of the following:

Year Ended December 31,

2008 2007 2006

Current:

Federal 201$ 2,979$ 3,786$

State and local 989 124 179

Foreign 834 513 2,071

2,024 3,616 6,036

Deferred:

Federal (98,858) 3,287 27,217

State and local (19,545) 4,690 3,476

(118,403) 7,977 30,693

(116,379)$ 11,593$ 36,729$

(In Thousands)

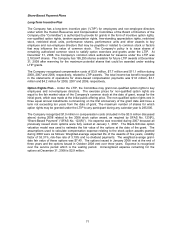

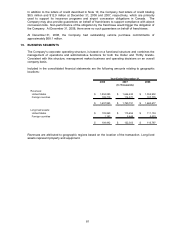

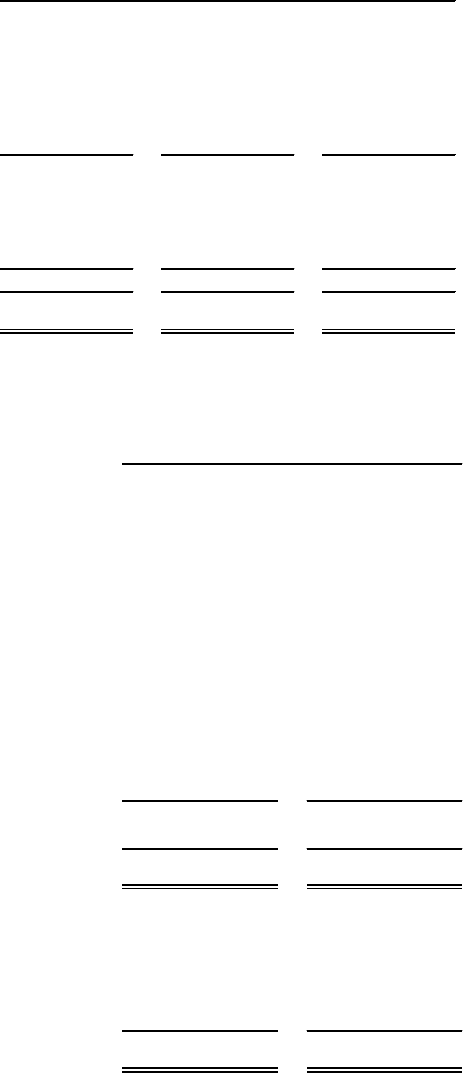

Deferred tax assets and liabilities consist of the following:

2008 2007

Deferred tax assets:

Vehicle insurance reserves 39,689$ 39,263$

Allowance for doubtful accounts and notes receivable 1,886 2,087

Other accrued liabilities 30,752 41,548

Federal and state NOL carryforwards 104,986 143,568

Interest rate swap 49,277 19,715

AMT credit carryforward 16,966 16,718

Intangible asset amortization 63,123 -

Canadian NOL carryforwards 10,672 19,880

Canadian depreciation 2,039 526

Other Canadian temporary differences 8,716 6

328,106 283,311

Valuation allowance (22,162) (23,186)

Total 305,944$ 260,125$

Deferred tax liabilities:

Depreciation 439,066$ 501,115$

Intangible asset amortization - 23,012

Other Canadian temporary differences - -

Other 521 3,410

Total 439,587$ 527,537$

December 31,

(In Thousands)

For the year ended December 31, 2008, the change in the net deferred tax liabilities constituted

($118.4 million) of deferred tax expense and ($15.4 million) of other comprehensive income that

relates to the interest rate swap and foreign currency translation.

76