Thrifty Car Rental 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.site under the heading, “Corporate Governance”. A copy of the code of business conduct, the corporate

governance policy and the charters are available upon request to the Company’s headquarters as listed

on the front of this Form 10-K, attention “Investor Relations” department.

The annual Chief Executive Officer certification required by the New York Stock Exchange (“NYSE”)

Listed Company Manual was submitted to the NYSE on May 20, 2008.

Industry Overview

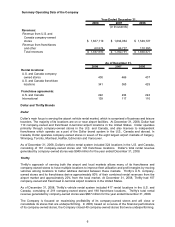

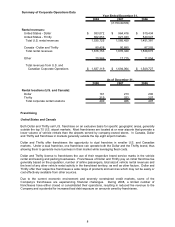

The U.S. daily car rental industry has two principal markets: the airport market and the local market.

Vehicle rental companies that focus on the airport market rent primarily to business and leisure travelers.

Companies focusing on the local market rent primarily to persons who need a vehicle periodically for

personal or business use or who require a temporary replacement vehicle. Rental companies also sell

used vehicles and ancillary products such as refueling services and loss damage waivers to vehicle

renters.

Vehicle rental companies typically incur substantial debt to finance their rental fleets. They also have

historically acquired a significant portion of their fleets under manufacturer residual value programs

(“Residual Value Programs”) where the vehicle manufacturers repurchase or guarantee the resale value

of vehicles at particular times in the future. This allows a rental company to determine in advance this

important component of its cost structure. Vehicles purchased under Residual Value Programs are

referred to as “Program Vehicles”. Most vehicle rental companies have in recent periods increased their

vehicle purchases made outside of Residual Value Programs to lower fleet costs and reduce the risk

related to the creditworthiness of the vehicle manufacturers. These vehicles, for which rental companies

bear residual value risk, are referred to as “Non-Program Vehicles” or “risk vehicles”. Increasing the level

of Non-Program Vehicles in the fleet increases the vehicle rental company’s dependence on the used car

market.

The rental car industry has eight top brands which are owned by four companies. Three of the companies

are publicly held: Dollar and Thrifty operated by the Company; Avis and Budget operated by Avis Budget

Group, Inc.; and Hertz operated by Hertz Global Holdings, Inc. The remaining three brands of Alamo,

National and Enterprise are operating subsidiaries of Enterprise Rent-A-Car Company, which is privately

held.

Seasonality

The Company’s business is subject to seasonal variations in customer demand, with the summer

vacation period representing the peak season for vehicle rentals. This general seasonal variation in

demand, along with more localized changes in demand, causes the Company to vary its fleet size over

the course of the year. To accommodate increased demand in the summer vacation periods, the

Company increases its available fleet and staff and as demand declines, the fleet and staff are decreased

accordingly. Certain operating expenses, such as minimum concession fees, rent, insurance and

administrative overhead represent fixed costs and cannot be adjusted for seasonal increases or

decreases in demand. In 2008, the Company’s average monthly fleet size ranged from a low of

approximately 102,000 vehicles in the fourth quarter to a high of approximately 139,000 vehicles in the

third quarter.

The Company

The Company has two value rental car brands, Dollar and Thrifty, with a strategy to operate company-

owned stores in the top 75 airport markets and in key leisure destinations in the United States. Due to

weak economic and industry conditions, the Company did not acquire any locations in 2008, and has no

immediate plans to acquire additional locations. In the U.S., the Dollar and Thrifty brands remain

separate, but operate under a single management structure and share vehicles, back-office employees

and facilities, where possible. The Company also operates company-owned stores in seven of the eight

largest airport markets in Canada under DTG Canada. In Canada, the company-owned stores are

primarily co-branded.

The Company also offers franchise opportunities in smaller markets in the U.S. and Canada and in all

international markets so that franchisees can operate under the Dollar or Thrifty trademarks or dual

franchise and operate both brands in one market.

5