Thrifty Car Rental 2008 Annual Report Download - page 46

Download and view the complete annual report

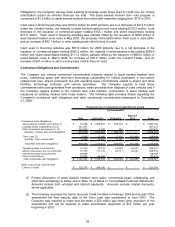

Please find page 46 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.directly from auctions, in the case of the Chrysler program, with any shortfall in value being paid

by Chrysler. With certain other vehicle manufacturers, the entire balance of proceeds from

vehicle sales come directly from the manufacturer. In either case, the Company bears the risk of

collectibility on that receivable from the vehicle manufacturer. The Company monitors its vehicle

manufacturer receivables based on time outstanding, manufacturer strength and length of the

relationship.

Vehicle insurance reserves – The Company does self-insure or retain a portion of the exposure

for losses related to bodily injury and property damage liability claims along with the risk retained

for the supplemental liability insurance program. The obligation for Vehicle Insurance Reserves

represents an estimate of both reported accident claims not yet paid and claims incurred but not

yet reported, up to the Company’s risk retention level. The Company records expense related to

Vehicle Insurance Reserves on a monthly basis based on rental volume in relation to historical

accident claim experience and trends, projections of ultimate losses, expenses, premiums and

administrative costs. Management monitors the adequacy of the liability and monthly accrual

rates based on actuarial analysis of the development of the claim reserves, the accident claim

history and rental volume. Since the ultimate disposition of the claims is uncertain, the likelihood

of materially different results is possible. However, the potential volatility of these estimates is

reduced due to the frequency of actuarial reviews and significant historical data available for

similar claims.

Income taxes – The Company estimates its consolidated effective state income tax rate using a

process that estimates state income taxes by entity and by tax jurisdiction. Changes in the

Company’s operations in these tax jurisdictions may have a material impact on the Company’s

effective state income tax rate and deferred state income tax assets and liabilities. Additionally,

the Company records deferred income tax assets and liabilities based on the temporary

differences between the financial reporting basis and the tax basis of the Company’s assets and

liabilities by applying enacted statutory tax rates that management believes will be applicable to

future years for these differences. Changes in tax laws and rates in future periods may materially

affect the amount of recorded deferred tax assets and liabilities. The Company also utilizes a

like-kind exchange program to defer tax basis gains on disposal of eligible revenue-earning

vehicles. This program requires the Company to make material estimates related to future fleet

activity. The Company’s income tax returns are periodically examined by various tax authorities

who may challenge the Company’s tax positions. While the Company believes its tax positions

are more likely than not supportable by tax rulings, interpretations, precedents or administrative

practices, there may be instances in which the Company may not succeed in defending a position

being examined. Resulting adjustments could have a material impact on the Company’s financial

position or results of operations.

Share-based payment plans – The Company has share-based compensation plans under which

the Company grants performance shares, non-qualified option rights and restricted stock to key

employees and non-employee directors. The Company’s performance share awards contain both

a performance condition and a market condition. Effective January 1, 2006, the Company

adopted SFAS No. 123(R), “Share-Based Payment” (“SFAS No. 123(R)”) using the modified

prospective application transition method. Under SFAS No. 123(R), the Company uses the

closing market price of DTG’s common stock on the date of grant to estimate the fair value of the

nonvested stock awards and performance based performance shares, and uses a lattice-based

option valuation model to estimate the fair value of market based performance shares. The

lattice-based option valuation model requires the input of somewhat subjective assumptions,

including expected stock price volatility, term, risk-free interest rate and dividend yield. The

Company relies on observations of historical volatility trends of the Company and its peers

(defined as the Russell 2000 Index), as determined by an independent third party, to determine

expected volatility. In determining the expected term, the Company observes the actual terms of

prior grants and the actual vesting schedule of the grant. The risk-free interest rate is the actual

U.S. Treasury zero-coupon rate for bonds matching the expected term of the award on the date

of grant. The expected dividend yield was estimated based on the Company’s current dividend

yield, and adjusted for anticipated future changes. The number of performance shares ultimately

earned will range from zero to 200% of the target award, depending on the Company’s

achievement of the performance and market conditions. Estimates of achievement of market

conditions are incorporated into the determination of the performance shares’ fair value at the

44