Thrifty Car Rental 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

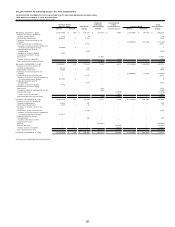

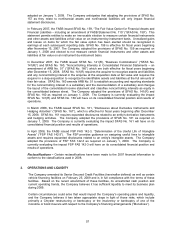

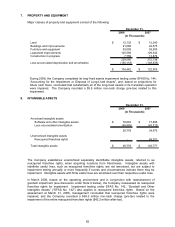

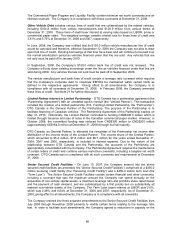

3. EARNINGS PER SHARE

The computation of weighted average common and common equivalent shares used in the

calculation of basic and diluted EPS is shown below:

2008 2007 2006

(In Thousands, Except Share and Per Share Data)

Net income (loss) (340,422)$ 1,215$ 51,692$

Basic EPS:

Weighted average common shares 21,375,589 22,580,298 24,195,933

Basic EPS (15.93)$ 0.05$ 2.14$

Diluted EPS:

Weighted average common shares 21,375,589 22,580,298 24,195,933

Shares contingently issuable:

Stock options - 168,075 264,098

Performance awards - 283,161 419,313

Employee compensation shares deferred - 414,518 270,085

Director compensation shares deferred - 179,560 169,370

Shares applicable to diluted 21,375,589 23,625,612 25,318,799

Diluted EPS (15.93)$ 0.05$ 2.04$

Year Ended December 31,

At December 31, 2008, 1,049,778 outstanding common stock equivalents that were anti-dilutive

were excluded from the computation of diluted EPS. At December 31, 2007 and 2006, all options to

purchase shares of common stock were included in the computation of diluted EPS because no

exercise price was greater than the average market price of the common shares.

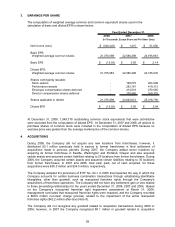

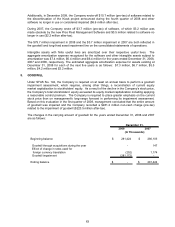

4. ACQUISITIONS

During 2008, the Company did not acquire any new locations from franchisees; however, it

distributed $2.1 million previously held in escrow to former franchisees in final settlement of

acquisitions made in previous periods. During 2007, the Company added seven locations by

acquiring its former franchisee in Seattle, Washington and Portland, Oregon and also acquired

certain assets and assumed certain liabilities relating to 29 locations from former franchisees. During

2006, the Company acquired certain assets and assumed certain liabilities relating to 35 locations

from former franchisees. In 2007 and 2006, total cash paid, net of cash acquired, for these

acquisitions were $30.3 million and $34.5 million, respectively.

The Company adopted the provisions of EITF No. 04-1 in 2005 that impacted the way in which the

Company accounts for certain business combination transactions through establishing identifiable

intangibles, other than goodwill, such as reacquired franchise rights through the Company’s

acquisitions of franchisee operations. The Company did not have any settlement gain or loss related

to these preexisting relationships for the years ended December 31, 2008, 2007 and 2006. Based

on the Company’s reacquired franchise right impairment assessment at March 31, 2008,

management concluded that reacquired franchise rights were impaired, and the Company recorded

a $69.0 million non-cash charge (pre-tax) related to the impairment of the entire reacquired

franchise rights ($42.2 million after-tax) (Note 8).

The Company did not recognize any goodwill related to acquisition transactions during 2008 or

2006; however, in 2007 the Company recognized $0.1 million in goodwill related to acquisition

59