Thrifty Car Rental 2008 Annual Report Download - page 57

Download and view the complete annual report

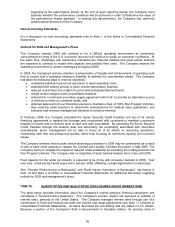

Please find page 57 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Website Development Costs – The Company capitalizes qualifying internal-use software

development, including Website development, incurred subsequent to the completion of the

preliminary project stage. Development costs are amortized over the shorter of the expected useful

life of the software or five years. Costs related to planning, maintenance, and minor upgrades are

expensed as incurred.

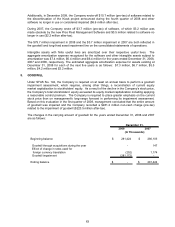

Goodwill – The excess of acquisition costs over the fair value of net assets acquired is recorded as

goodwill. In accordance with Statement of Financial Accounting Standards (“SFAS”) No. 142,

“Goodwill and Other Intangible Assets,” goodwill is no longer amortized but instead is tested for

impairment at least annually (Note 9).

Long–Lived Assets – The Company reviews the value of long-lived assets, including software and

other intangible assets, for impairment whenever events or changes in circumstances indicate that

the carrying amount of an asset may not be recoverable based upon estimated future cash flows.

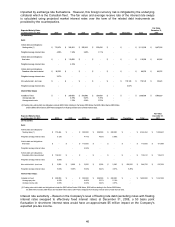

Accounts Payable – Book overdrafts of $7.6 million and $16.3 million, which represent outstanding

checks not yet presented to the bank, are included in accounts payable at December 31, 2008 and

2007, respectively. These amounts do not represent bank overdrafts, which would constitute

checks presented in excess of cash on hand, and would be effectively a loan to the Company.

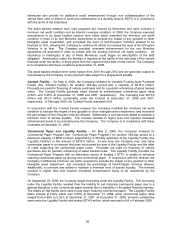

Derivative Instruments – The Company uses SFAS No. 133 “Accounting for Derivative

Instruments and Hedging Activities”, as amended (“SFAS No. 133”), which requires that all

derivatives be recorded on the balance sheet as either assets or liabilities measured at their fair

value, and that changes in the derivatives’ fair value be recognized currently in earnings unless

specific hedge accounting criteria are met. Beginning in 2001 and continuing through 2006, the

Company entered into interest rate swap agreements. These interest rate swap agreements do not

qualify for hedge accounting treatment under SFAS No. 133; therefore, the changes in the interest

rate swap agreements’ fair values have been recognized as an (increase) decrease in fair value of

derivatives in the consolidated statement of operations. In May 2007, the Company entered into an

interest rate swap agreement related to the 2007 Series notes (hereinafter defined) which

constitutes a cash flow hedge and qualifies for hedge accounting treatment under SFAS No. 133,

utilizing the “long-haul” method (Note 11).

Vehicle Insurance Reserves – Provisions for public liability and property damage and

supplemental liability insurance (“SLI”) on self-insured claims are made by charges primarily to

direct vehicle and operating expense. Accruals for such charges are based upon actuarially

determined evaluations of estimated ultimate liabilities on reported and unreported claims, prepared

on at least an annual basis. Historical data related to the amount and timing of payments for self-

insured claims is utilized in preparing the actuarial evaluations. The accrual for public liability and

property damage claims is discounted based upon the actuarially determined estimated timing of

payments to be made in the future. Management reviews the actual timing of payments as

compared with the annual actuarial estimate of timing of payments and has determined that there

have been no material differences in the timing of payments for each of the three years in the period

ended December 31, 2008. Because of less predictability, self-insured reserves for SLI are not

discounted.

Foreign Currency Translation – Foreign assets and liabilities are translated using the exchange

rate in effect at the balance sheet date, and results of operations are translated using an average

rate for the period. Translation adjustments are accumulated and reported as a component of

accumulated other comprehensive income (loss).

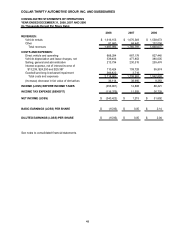

Revenue Recognition – Revenues from vehicle rentals are recognized as earned on a daily basis

under the related rental contracts with customers. Revenues from leasing vehicles to franchisees

are principally under operating leases with fixed monthly payments and are recognized as earned

over the lease terms. Revenues from fees and services include providing sales and marketing,

55