Thrifty Car Rental 2008 Annual Report Download - page 68

Download and view the complete annual report

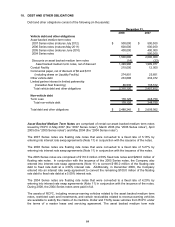

Please find page 68 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Commercial Paper Program and Liquidity Facility contain minimum net worth covenants and an

interest covenant. The Company is in compliance with these covenants at December 31, 2008.

Other Vehicle Debt includes various lines of credit that are collateralized by the related vehicles,

including $104.8 million from vehicle manufacturers and $128.9 million from various banks at

December 31, 2008. These lines of credit bear interest at varying rates based on LIBOR, prime or

commercial paper rates. The weighted average variable interest rate for these lines of credit was

3.81% and 6.75% at December 31, 2008 and 2007, respectively.

In June, 2008, the Company was notified that its $150.0 million vehicle manufacturer line of credit

would be canceled and therefore, effective September 12, 2008 the Company was not able to draw

upon that line of credit. Existing borrowings at that time have been and will continue to be paid over

the normal amortization period as vehicles financed under that line are sold. Any vehicles that are

not sold must be paid off in January 2010.

In September, 2008, the Company’s $150.0 million bank line of credit was not renewed. The

Company will pay down existing borrowings under the line as vehicles financed under that line are

sold during 2009. Any vehicles that are not sold must be paid off in September 2009.

The vehicle manufacturer and bank lines of credit contain a leverage ratio covenant which requires

that the Company’s corporate debt to corporate EBITDA be maintained within certain limits as

defined in the respective agreements. Giving effect to all amendments, the Company is in

compliance with all covenants at December 31, 2008. In February 2009, the Company amended

these lines of credit. See Note 21 for further discussion.

Limited Partner Interest in Limited Partnership – DTG Canada has a partnership agreement (the

“Partnership Agreement”) with an unrelated bank’s conduit (the “Limited Partner”). This transaction

included the creation of a limited partnership (TCL Funding Limited Partnership, the “Partnership”).

DTG Canada is the General Partner of the Partnership. The purpose of the Partnership is to

facilitate financing of Canadian vehicles. The Partnership Agreement of the Partnership expires on

May 31, 2010. Historically, the Limited Partner committed to funding CND$300.0 million which is

funded through issuance and sale of notes in the Canadian commercial paper market. However, in

October 2008, the committed funding was reduced from CND$300 million to CND$200 million

(approximately US$164.0 million at December 31, 2008) through its final maturity.

DTG Canada, as General Partner, is allocated the remainder of the Partnership net income after

distribution of the income share of the Limited Partner. The income share of the Limited Partner,

which amounted to $5.4 million, $7.8 million and $6.7 million for the years ended December 31,

2008, 2007 and 2006, respectively, is included in interest expense. Due to the nature of the

relationship between DTG Canada and the Partnership, the accounts of the Partnership are

appropriately consolidated with the Company. The Partnership Agreement requires the maintenance

of certain letters of credit and contains various restrictive covenants, including a tangible net worth

covenant. DTG Canada was in compliance with all such covenants and requirements at December

31, 2008.

Senior Secured Credit Facilities – On June 15, 2007, the Company entered into the senior

secured credit facilities (as amended, the “Senior Secured Credit Facilities”) comprised of a $350.0

million revolving credit facility (the “Revolving Credit Facility”) and a $250.0 million term loan (the

“Term Loan”). The Senior Secured Credit Facilities contain certain financial and other covenants,

including a covenant that sets the maximum amount the Company can spend annually on the

acquisition of non-vehicle capital assets, a maximum leverage ratio and prohibits share repurchases

and the payment of cash dividend, and are collateralized by a first priority lien on substantially all

material non-vehicle assets of the Company. The Term Loan bears interest at LIBOR plus 2.0%,

which was 2.46% and 6.84% at December 31, 2008 and 2007, respectively. As of December 31,

2008, giving effect to all amendments, the Company is in compliance with all covenants.

The Company entered into three separate amendments to the Senior Secured Credit Facilities from

July 2008 through November 2008 primarily to modify certain terms relating to the leverage ratio

test. In order to facilitate such amendments, the Company agreed to reductions in capacity on the

66