Thrifty Car Rental 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

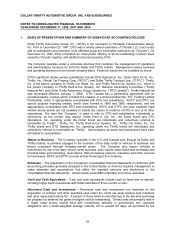

transactions. Reacquired franchise rights and a portion of goodwill are both deductible for tax

purposes. Each of the acquisitions has been accounted for using the purchase method of

accounting and operating results of the acquirees from the dates of acquisition are included in the

consolidated statements of operations of the Company. Acquisitions made in each year are not

material individually or collectively to amounts presented for each of the years ended December 31,

2008, 2007 and 2006.

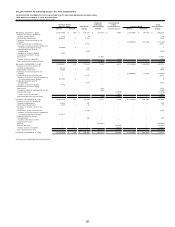

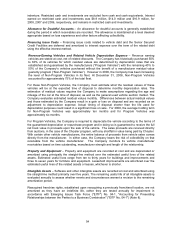

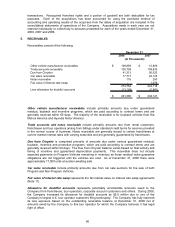

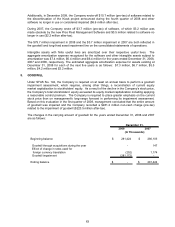

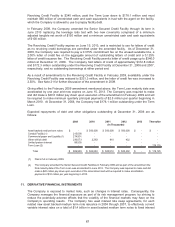

5. RECEIVABLES

Receivables consist of the following:

2008 2007

Other vehicle manufacturer receivables 109,859$ 15,809$

Trade accounts receivable 105,759 109,833

Due from Chrysler 41,313 95,023

Car sales receivable 17,717 22,125

Notes receivable 116 250

Fair value of interest rate swap - 1,078

274,764 244,118

Less allowance for doubtful accounts (13,199) (5,991)

261,565$ 238,127$

December 31,

(In Thousands)

Other vehicle manufacturer receivables include primarily amounts due under guaranteed

residual, buyback and incentive programs, which are paid according to contract terms and are

generally received within 60 days. The majority of the receivable is for buyback vehicles from Kia

Motors America and Hyundai Motor America.

Trade accounts and notes receivable include primarily amounts due from rental customers,

franchisees and tour operators arising from billings under standard credit terms for services provided

in the normal course of business. Notes receivable are generally issued to certain franchisees at

current market interest rates with varying maturities and are generally guaranteed by franchisees.

Due from Chrysler is comprised primarily of amounts due under various guaranteed residual,

buyback, incentive and promotion programs, which are paid according to contract terms and are

generally received within 60 days. The Due from Chrysler balance varies based on fleet activity and

timing of incentive and guaranteed depreciation payments. This receivable does not include

expected payments on Program Vehicles remaining in inventory as those residual value guarantee

obligations are not triggered until the vehicles are sold. As of December 31, 2008 there were

approximately 17,000 units at auction awaiting sale.

Car sales receivable include primarily amounts due from car sale auctions for the sale of both

Program and Non-Program Vehicles.

Fair value of interest rate swap represents the fair market value on interest rate swap agreements

(Note 11).

Allowance for doubtful accounts represents potentially uncollectible amounts owed to the

Company from franchisees, tour operators, corporate account customers and others. During 2008,

the Company increased its allowance for doubtful accounts by $5.5 million due to one of the

Company’s largest U.K. tour operator customers filing bankruptcy. The Company has fully reserved

its loss exposure based on the outstanding receivable balance at December 31, 2008 net of

amounts owed by the Company to this tour operator for which the Company believes it has legal

right of offset.

60