Symantec 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 Symantec 2003

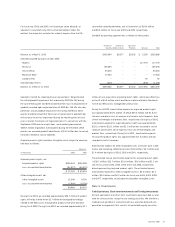

The principal components of deferred tax assets were as follows:

March 31,

(IN THOUSANDS) 2003 2002

Deferred tax assets:

Tax credit carryforwards $8,712 $1,618

Net operating loss carryforwards of

acquired companies 43,874 25,029

Other accruals and reserves not currently

tax deductible 49,485 37,421

Deferred revenue 21,000 9,736

Loss on investments not currently tax

deductible 10,375 10,199

Other 7,117 10,675

140,563 94,678

Valuation allowance (5,111) (5,111)

Deferred tax assets 135,452 89,567

Deferred tax liabilities:

Acquired intangible assets (13,010) (11,353)

Tax over book depreciation (8,012) (1,697)

Unremitted earnings of foreign subsidiaries (14,160) (1,689)

Net deferred tax assets $100,270 $74,828

Realization of a significant portion of approximately $100.3 million of

net deferred tax assets is dependent upon our ability to generate suffi-

cient future taxable income and the implementation of tax planning

strategies. We believe it is more likely than not that the net deferred tax

assets will be realized based on historical earnings, expected levels of

future taxable income in the U.S. and certain foreign jurisdictions, and

the implementation of tax planning strategies. The valuation allowance

remained unchanged during fiscal 2003 and 2002.

As of March 31, 2003, we have tax credit carryforwards of approximately

$8.7 million that expire in fiscal 2004 through 2008. In addition, we

have net operating loss carryforwards attributable to various acquired

companies of approximately $111.4 million that expire in fiscal 2011

through 2022. These net operating loss carryforwards are subject to an

annual limitation under Internal Revenue Code §382, but are expected

to be fully realized.

Pretax income from international operations was approximately $225.4

million, $168.4 million and $144.9 million for fiscal 2003, 2002 and

2001, respectively.

No provision has been made for federal or state income taxes on

approximately $490.6 million of cumulative unremitted earnings of

certain of our foreign subsidiaries as of March 31, 2003, since we plan

to indefinitely reinvest these earnings. As of March 31, 2003, the unrec-

ognized deferred tax liability for these earnings was approximately

$127.6 million.

Note 15. Litigation

On March 28, 2003, Ronald Pearce filed a lawsuit on behalf of himself

and purportedly on behalf of the general public of the United States and

Canada in the California Superior Court, Santa Clara County, alleging

violations of California Business and Professions Code section 17200

and false advertising in connection with our WinFax Pro product. The

complaint seeks damages and injunctive and other equitable relief,

as well as costs and attorney fees. We intend to defend the action

vigorously.

On February 27, 2003, PowerQuest Corporation filed a lawsuit against

us in the United States District Court, District of Utah, alleging that

our Ghost product infringes a patent owned by them. The complaint

seeks damages and injunctive relief. We intend to defend the action

vigorously.

On February 7, 2003, Cathy Baker filed a lawsuit against us, Microsoft

and two retailers in the California Superior Court, Marin County, pur-

portedly on behalf of the general public of California and of a class of

certain purchasers of software products. An amended complaint filed

in May 2003 adds Greg Johnson as plaintiff and Adobe Systems and

another retailer as defendants. The complaint alleges that our refund

policies violate consumer warranty and unfair business practice laws.

The lawsuit seeks damages, rescission and injunctive relief, as well as

costs and attorney fees. We intend to defend the action vigorously.

On November 29, 2002, William Pereira filed a purported class action

lawsuit against a local retailer and us in the Supreme Court of New York,

New York County, alleging breach of contract and deceptive business

practices in connection with rebates offered by us. The complaint was

served March 26, 2003. The complaint seeks damages, costs and attor-

ney fees. We intend to defend the action vigorously.

On June 14, 2002, Hark Chan and Techsearch LLC filed a lawsuit

against us in the United States District Court for the Northern District

of California, alleging that unspecified products sold on CD-ROM with

Internet hyperlinks and/or with the LiveUpdate feature infringe a patent

owned by Techsearch. Subsequently, IP Innovation LLC was added as a

plaintiff. The lawsuit requests damages, injunctive relief, costs and

attorney fees. We intend to defend the action vigorously.

In May 2002, Craig Hughes filed a lawsuit in Utah state court, purport-

edly on behalf of a class of persons located in Utah who he asserts

received unsolicited commercial email from us. The complaint alleges

violation of Utah’s recently enacted Unsolicited Commercial Email Act.

The lawsuit requests damages, costs and attorney fees. In January

2003, the parties to the lawsuit submitted to the court a stipulated

request for dismissal.

On December 23, 1999, Altiris Inc. filed a lawsuit against us in the

United States District Court, District of Utah, alleging that unspecified

Symantec products including Norton Ghost Enterprise Edition, infringed

a patent owned by Altiris. The lawsuit requests damages, injunctive

relief, costs and attorney fees. In October 2001, a stipulated judgment

of non-infringement was entered following the court’s ruling construing

the claims of the Altiris patent, and in February 2003, the Court of