Symantec 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Symantec 2003 53

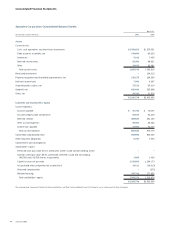

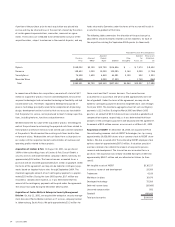

Note 2. Statements of Operations Information

Year Ended March 31,

(IN THOUSANDS) 2003 2002 2001

Technical support costs included

in sales and marketing $19,735 $15,871 $18,502

Advertising expense $46,495 $34,657 $46,884

Technical support costs, included in sales and marketing, relate to the

cost of providing free post-contract support and were accrued at the

time of product sale. Advertising expenditures were charged to opera-

tions as incurred.

Note 3. Acquisitions and Divestitures

During the September 2002 quarter, we acquired four privately-held

companies for a total of approximately $375.2 million in cash. We expect

that the acquisition of these emerging technologies will strengthen our

competitive position in the enterprise security solutions and managed

security services markets. The results of operations of the acquired

companies have been included in our operations as of the dates of

acquisition. These acquired companies are included in our Enterprise

Security segment, with the exception of Riptech, which is included in

our Services segment.

Riptech On August 19, 2002, we acquired Riptech, Inc., a provider of

scalable, real-time managed security services that protect clients

through advanced outsourced security monitoring and professional

services, for $145.0 million. Under the transaction, we recorded approx-

imately $2.1 million for acquired in-process research and development,

$12.2 million for developed technology, $0.5 million for acquired prod-

uct rights, including revenue related order backlog and contracts,

$117.8 million for goodwill, $8.0 million for net deferred tax assets

and $7.6 million for tangible assets, net of liabilities. We also accrued

approximately $3.2 million in acquisition related expenses, which

included financial advisory, legal and accounting fees, duplicative sites

and severance costs, of which $0.9 million remains as an accrual as of

March 31, 2003.

The amounts allocated to developed technology and acquired product

rights will be amortized to cost of revenues over their useful lives of five

years and one year, respectively.

During the December 2002 quarter, we revised estimates related to

certain liabilities, and as a result, we decreased the purchase price and

goodwill by $0.9 million.

Recourse On August 19, 2002, we acquired Recourse Technologies,

Inc., a provider of security threat management solutions that detect,

analyze and respond to both known and novel threats, including intru-

sions, internal attacks and denial of service attacks, for approximately

$135.3 million. Under the transaction, we recorded approximately $1.0

million for acquired in-process research and development, $19.0 million

for developed technology, $109.3 million for goodwill, $2.2 million for

other intangibles, $9.1 million for net deferred tax assets and $1.9 mil-

lion for liabilities, net of tangible assets. We also accrued approximately

$3.3 million in acquisition related expenses, which included financial

advisory, legal, tax and accounting fees, duplicative sites and severance

costs, of which $1.0 million remains as an accrual as of March 31, 2003.

The amount allocated to developed technology will be amortized to cost

of revenues over the useful life of four years. The amount allocated to

other intangibles will be amortized to operating expenses over its useful

life of one year.

During the December 2002 quarter, we revised estimates related to

certain liabilities, and as a result, we decreased the purchase price and

goodwill by $0.2 million.

SecurityFocus On August 5, 2002, we acquired SecurityFocus, Inc., a

provider of enterprise security threat management systems, providing

global early warning of cyber attacks, customized and comprehensive

threat alerts, and countermeasures to prevent attacks before they occur,

for approximately $74.9 million. Under the transaction, we recorded

approximately $1.6 million for acquired in-process research and devel-

opment, $3.5 million for developed technology, $3.3 million for acquired

product rights, including database and revenue related order backlog

and contracts, $64.3 million for goodwill, $2.1 million for other market-

ing related intangibles, $0.5 million for net deferred tax assets and $1.2

million for tangible assets, net of liabilities. We also accrued approxi-

mately $1.7 million in acquisition related expenses, which included

legal, tax and accounting fees, duplicative site and fixed asset expenses,

and severance costs, of which $0.9 million remains as an accrual as of

March 31, 2003.

The amounts allocated to developed technology and acquired product

rights will be amortized to cost of revenues over their useful lives of one

to four years. The amount allocated to other intangibles will be amor-

tized to operating expenses over its useful life of four years.

During the December 2002 quarter, we revised estimates related to

certain liabilities, and as a result, we decreased the purchase price and

goodwill by $37,000.

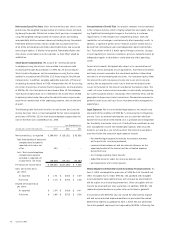

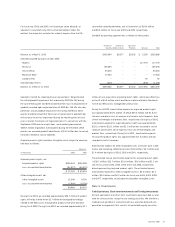

Mountain Wave On July 2, 2002, we acquired Mountain Wave, Inc., a

provider of automated attack sensing and warning software and serv-

ices for real-time enterprise security operations management, for $20.0

million. Under the transaction, we recorded approximately $2.0 million

for developed technology, $17.3 million for goodwill, $1.7 million for net

deferred tax assets and $0.4 million for liabilities, net of tangible assets.

We also accrued approximately $0.7 million in acquisition related

expenses, which included legal and accounting fees, as well as duplica-

tive site and severance costs. As of March 31, 2003, all costs have been

paid with the exception of an immaterial amount for outplacement

services and duplicative site costs.

The amount allocated to developed technology will be amortized to cost

of revenues over its useful life of five years.