Symantec 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 Symantec 2003

which had a fair value of approximately $1.9 million and $1.1 million as

of March 31, 2003 and 2002, respectively. Any activity related to these

trading assets has a corresponding effect on the carrying value of the

related deferred compensation liability. These trading assets have not

been separately disclosed on the balance sheet due to their immaterial

amounts and were instead included in the following tabular disclosures.

The estimated fair value of the cash equivalents and short-term invest-

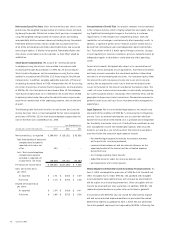

ments consisted of the following:

March 31,

(IN THOUSANDS) 2003 2002

Corporate securities $688,805 $478,632

Taxable auction rate securities 258,250 226,906

Money market funds 151,307 201,107

Asset backed securities 176,860 168,427

Corporate bonds 63,448 104,015

U.S. government and government-

sponsored securities 218,082 65,089

Bank securities and deposits 37,219 7,845

Total available-for-sale and trading

investments 1,593,971 1,252,021

Less: amounts classified as cash

equivalents (182,919) (256,207)

$1,411,052 $995,814

The estimated fair value of cash equivalents and short-term investments

by contractual maturity as of March 31, 2003 was as follows:

(IN THOUSANDS)

Due in one year or less $1,451,785

Due after one year and through three years 142,186

$1,593,971

Fair values of cash equivalents, short-term investments and trading

assets approximate cost primarily due to the short-term maturities of

the investments and the absence of changes in security credit ratings.

As of March 31, 2003 and 2002, we held no publicly traded equity secu-

rities. As of March 31, 2001, equity securities of approximately $7.5 mil-

lion consisted of 623,247 shares of Interact. During the March 2001

quarter, Interact entered into a plan to merge with The Sage Group plc

and we recorded a loss of approximately $12.5 million as other expense

related to the other than temporary decline in value of our investment in

Interact. As a result of the merger, we received approximately $7.5 mil-

lion upon the surrender of the Interact shares in July 2001.

Unrealized gains and losses on available-for-sale securities were

reported as a component of stockholders’ equity and were approxi-

mately $1.7 million and $0.7 million as of March 31, 2003 and 2002,

respectively.

Unregistered Equity Investments As of March 31, 2003 and 2002, we

held equity investments with a carrying value of approximately $10.5

million in six privately held companies and $8.4 million in three pri-

vately held companies, respectively. These investments were recorded at

cost as we do not have significant influence over the investee and are

classified as other long-term assets on the Consolidated Balance Sheets.

During the September 2002 and March 2001 quarters, we recognized a

decline in value of approximately $0.8 million and $12.6 million, respec-

tively, determined to be other than temporary on certain privately held

investments. Also during the March 2001 quarter, we recorded a gain of

approximately $0.9 million on another investment, as a result of this

privately held company being acquired by another entity. This invest-

ment was acquired as a result of our acquisition of AXENT. The other

than temporary decline in value and gain on investments were recorded

as other expense, net on the Consolidated Statements of Operations.

Derivative Financial Instruments During the periods covered by the

consolidated financial statements, we did not use any derivative instru-

ment for trading purposes. We utilize some natural hedging to mitigate

our exposures and we manage certain residual balance sheet exposures

through the use of one-month forward foreign exchange contracts. We

enter into forward foreign exchange contracts with financial institutions

primarily to minimize currency exchange risks associated with certain

balance sheet positions. The fair value of forward foreign exchange con-

tracts approximates cost due to the short maturity periods. As of March

31, 2003, the notional amount of our forward foreign exchange con-

tracts was approximately $67.3 million, all of which mature in 35 days

or less. We do not hedge our foreign currency translation risk.

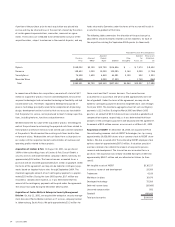

Note 6. Convertible Subordinated Notes

On October 24, 2001, we completed a private offering of $600.0 million

of 3% convertible subordinated notes due November 1, 2006, the net

proceeds of which were approximately $584.6 million. The notes are

convertible into shares of our common stock by the holders at any time

before maturity at a conversion price of $34.14 per share, subject to

certain adjustments. During fiscal 2003, an immaterial principal amount

of our notes were converted into shares of our common stock. We may

redeem the remaining notes on or after November 5, 2004, at a redemp-

tion price of 100.75% of stated principal during the period November 5,

2004 through October 31, 2005 and 100% thereafter. Interest is paid

semi-annually and we commenced making these payments on May 1,

2002. Debt issuance costs of approximately $15.8 million, related to the

notes, is amortized on a straight-line basis through November 1, 2006.

We have reserved approximately 17.6 million shares of common stock

for issuance upon conversion of the notes.

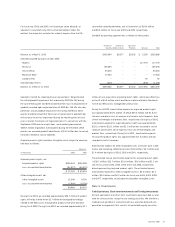

Note 7. Commitments

We lease certain of our facilities and equipment under operating leases

that expire at various dates through 2018. We currently sublease some

space under various operating leases that will expire at various dates

through 2013.