Symantec 2003 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 Symantec 2003

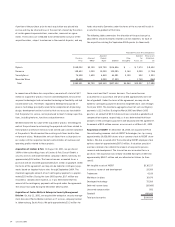

Stock option balances were as follows:

March 31,

(IN THOUSANDS) 2003 2002

Authorized and/or outstanding 38,030 38,511

Available for future grants 14,864 9,727

Exercisable and vested 9,287 8,434

The following table summarizes information about options outstanding as of March 31, 2003:

Outstanding Options Exercisable Options

Weighted

Number Average Weighted Number Weighted

of Shares Contractual Average of Shares Average

Range of Exercise Prices (in thousands) Life (in years) Exercise Price (in thousands) Exercise Price

$4.50 – $17.25 4,850 6.27 $12.16 3,095 $11.34

17.28 – 22.22 4,969 7.70 18.43 1,813 18.48

22.28 – 32.18 4,846 7.75 28.31 2,013 27.89

32.32 – 33.66 5,024 8.77 32.90 983 32.86

33.71 – 47.92 3,930 8.24 37.48 1,383 35.19

23,619 7.73 $25.42 9,287 $22.15

These options will expire if not exercised by specific dates through

March 2013. Prices for options exercised during the three years ended

March 31, 2003 ranged from $2.81 to $40.19.

We elected to follow APB No. 25, Accounting for Stock Issued to

Employees, in accounting for our employee stock options because the

alternative fair value accounting provided for under SFAS No. 123,

Accounting for Stock-Based Compensation, requires the use of option

valuation models that were not developed for use in valuing employee

stock options. Under APB No. 25, because the exercise price of our

employee stock options generally equals the market price of the

underlying stock on the date of grant, no compensation expense is

recognized in our consolidated financial statements.

Pro forma information regarding net income (loss) and net income (loss)

per share is required by SFAS No. 123. This information is required to

be determined as if we had accounted for our employee stock options,

including shares issued under the Employee Stock Purchase Plan, collec-

tively called “options,” granted subsequent to March 31, 1995 under

the fair value method of that statement. The fair value of options

granted during fiscal 2003, 2002 and 2001 reported below has been

estimated at the date of grant using the Black-Scholes option-pricing

model assuming no expected dividends and the following weighted

average assumptions:

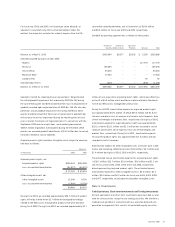

Employee Stock Options Employee Stock Purchase Plans

2003 2002 2001 2003 2002 2001

Expected life (years) 5.23 5.62 5.01 0.50 0.50 0.50

Expected volatility 0.72 0.76 0.71 0.59 0.80 0.84

Risk free interest rate 3.12% 4.60% 4.50% 1.35% 2.70% 6.00%