Symantec 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Symantec 2003 59

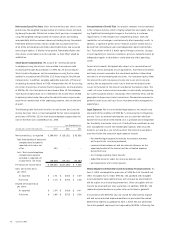

The future fiscal year minimum operating lease commitments were as

follows as of March 31, 2003:

(IN THOUSANDS)

2004 $ 31,306

2005 24,069

2006 19,036

2007 15,322

2008 8,650

Thereafter 7,291

Operating lease commitments 105,674

Sublease income (20,120)

Net operating lease commitments $ 85,554

Based on existing subleases, we expect to record future sublease

income of approximately $6.6 million, $5.5 million, $3.5 million, $2.3

million, $0.5 million and $1.7 million during fiscal 2004, 2005, 2006,

2007, 2008 and thereafter, respectively.

Rent expense charged to operations totaled approximately $28.8 mil-

lion, $25.2 million and $22.9 million during fiscal 2003, 2002 and 2001,

respectively.

In March 2003, we terminated our operating lease obligations for four

facilities located in Cupertino, California, Springfield, Oregon, and

Newport News, Virginia by purchasing the land and buildings for approx-

imately $17.9 million and $106.0 million, respectively.

Note 8. Stock Split

On December 14, 2001, the Board of Directors approved a two-for-one

stock split of Symantec’s common stock effected as a stock dividend,

which became effective as of January 31, 2002 to stockholders of record

on January 17, 2002. Based on the number of shares outstanding on

January 17, 2002, the stock dividend resulted in the issuance of approx-

imately 70.7 million additional shares of Symantec’s common stock. All

Symantec share and per share amounts in prior periods have been

adjusted to give retroactive effect to the stock dividend.

Note 9. Common Stock Repurchases

On January 16, 2001, the Board of Directors replaced an earlier stock

repurchase program with a new authorization to repurchase up to

$700.0 million of Symantec common stock, not to exceed 30.0 million

shares, with no expiration date. As of March 31, 2003, we had repur-

chased a total of 21.9 million shares under this program at prices

ranging from $17.78 to $29.97 per share, for an aggregate amount of

approximately $513.2 million. During fiscal 2003, we repurchased 2.2

million shares at prices ranging from $27.93 to $29.97 per share, for an

aggregate amount of approximately $64.3 million. During fiscal 2002,

we repurchased 9.6 million shares at prices ranging from $17.78 to

$24.50 per share, for an aggregate amount of approximately $204.4

million. During fiscal 2001, we repurchased 10.0 million shares at prices

ranging from $23.04 to $25.58 per share, for an aggregate amount of

approximately $244.4 million.

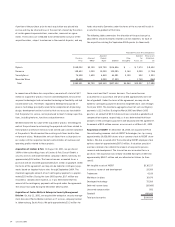

Note 10. Net Income (Loss) per Share

The components of net income (loss) per share were as follows:

Year Ended March 31,

(IN THOUSANDS, EXCEPT PER SHARE DATA) 2003 2002 2001

Basic Net Income (Loss) Per Share

Net income (loss) $248,438 $ (28,151) $ 63,936

Weighted average number of

common shares outstanding

during the period 145,395 143,604 129,474

Basic net income (loss) per share $1.71 $(0.20) $ 0.49

Diluted Net Income (Loss) Per Share

Net income (loss) $248,438 $ (28,151) $ 63,936

Interest on convertible subor-

dinated notes, net of income

tax effect 14,393 ––

Net income (loss), as adjusted $262,831 $ (28,151) $ 63,936

Weighted average number of

common shares outstanding

during the period 145,395 143,604 129,474

Shares issuable from assumed

conversion of options 7,748 –7,000

Shares issuable from assumed

conversion of convertible

subordinated notes 17,575 ––

Total shares for purpose of

calculating diluted net

income (loss) per share 170,718 143,604 136,474

Diluted net income (loss)

per share $1.54 $(0.20) $ 0.47

During fiscal 2003, 2002 and 2001, approximately 0.7 million, 13.8 mil-

lion and 8.3 million shares, respectively, issuable from assumed exercise

of options were excluded from the computation of diluted net income

(loss) per share, as the effect would have been anti-dilutive.

During fiscal 2002, approximately 7.6 million shares issuable upon con-

version of the 3% convertible subordinated notes were excluded from

the computation of diluted net income (loss) per share, as their effect

would have been anti-dilutive.

Note 11. Adoption of Stockholder Rights Plan

On August 11, 1998, the Board of Directors adopted a stockholder rights

plan designed to ensure orderly consideration of any future unsolicited

acquisition attempt to ensure fair value of us for our stockholders.