Symantec 2003 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Symantec 2003 65

outplacement services. In addition, we provided approximately $1.2 mil-

lion for costs of severance and related benefits for six members of our

senior management due to a realignment of certain responsibilities.

These severance, related benefits, and outplacement costs were paid

by the end of the September 2001 quarter.

During the December 2000 quarter, we reduced a portion of our opera-

tions in Toronto, thereby terminating 10 employees, and recorded

approximately $400,000 for the costs of severance, related benefits

and abandonment of certain equipment. In addition, approximately

$900,000 was provided for costs of severance and related benefits for

four members of our senior management due to a realignment of certain

responsibilities. These severance and related benefits were paid by the

end of the March 2001 quarter.

The exit plans associated with each of the reductions in workforce and

facility closures above specifically identified all the significant actions,

including:

•the names of individuals who would not continue employ-

ment with us;

•the termination dates and severance packages for each

terminating employee;

•the date we would vacate the facilities which were under

existing operating leases; and

•the specific excess equipment, furniture, fixtures and

leasehold improvements to be disposed.

Employee severance and outplacement was primarily comprised of sev-

erance packages for employees who were terminated as a result of the

restructurings. As part of each restructuring, we specifically identified

those individuals who would not continue employment with us. The

severance periods ranged from one to six months. The total cost of the

severance packages was accrued and included in a restructuring charge

after the identified employees had their severance packages communi-

cated to them. Additionally, we accrued estimated costs associated with

outplacement services to be provided to terminating employees, as

these costs have no future economic benefit to us. The remaining accrual

as of March 31, 2003 was primarily for outstanding severance, benefits

and outplacement costs and will be paid by the first quarter of fiscal 2004.

Excess facilities and equipment included 1) remaining lease payments

associated with building leases subsequent to their abandonment dates,

2) net of estimated sublease income, and/or 3) estimated lease termina-

tion costs. The cash outlays for these leases are to be made over the

remaining term of each lease, unless a lease termination payment is

required. In addition, we wrote off the carrying value of site-specific

equipment, furniture, fixtures and leasehold improvements, which

would no longer be utilized. The accrual as of March 31, 2003 relates

primarily to the remaining lease payments, net of estimated sublease

income, which will be paid over the remaining lease term subsequent to

the abandonment of each facility through fiscal year 2007.

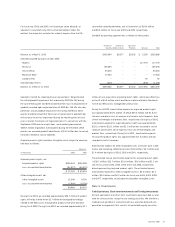

Note 14. Income Taxes

The components of the provision for income taxes were as follows:

Year Ended March 31,

(IN THOUSANDS) 2003 2002 2001

Current:

Federal $58,732 $24,508 $ 55,019

State 15,045 9,543 14,741

International 45,809 26,045 30,411

119,586 60,096 100,171

Deferred:

Federal (620) 13,802 (16,677)

State (2,465) 1,512 (5,386)

International (1,308) (1,761) (1,264)

(4,393) 13,553 (23,327)

$115,193 $73,649 $ 76,844

The difference between our effective income tax rate and the federal

statutory income tax rate as a percentage of income before income

taxes was as follows:

Year Ended March 31,

2003 2002 2001

Federal statutory rate 35.0% 35.0% 35.0%

State taxes, net of federal benefit 2.1 15.8 4.3

Acquired in-process research and

development charges with no

tax benefit ––5.5

Non-deductible goodwill amortization –148.5 16.8

Foreign earnings taxed at less than

the federal rate (5.7) (30.8) (11.5)

Valuation allowance for potential

non-deductible loss on investment ––3.1

Research tax credits –(2.2) (0.7)

Benefit of exempt foreign sales

income –(2.0) (0.2)

Other, net 0.3 (2.4) 2.3

31.7% 161.9% 54.6%