Symantec 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 Symantec 2003

In connection with the plan, the Board of Directors declared and paid

a dividend of one preferred share purchase right for each share of

Symantec common stock outstanding on the record date, August 21,

1998. Each right entitles the holder, under certain circumstances, to

purchase from us one two-thousandth of a share of our Series A Junior

Participating Preferred Stock, par value $0.01 per share, at a price of

$150.00 per one one-thousandth of a share of Series A Junior

Participating Preferred Stock, subject to adjustment.

The rights are initially attached to Symantec common stock and will not

trade separately. If a person or a group, an Acquiring Person, acquires

20% or more of our common stock, or announces an intention to make

a tender offer for 20% or more of our common stock, the rights will be

distributed and will thereafter trade separately from the common stock.

If the rights become exercisable, each right (other than rights held by

the Acquiring Person) will entitle the holder to purchase, at a price equal

to the exercise price of the right, a number of shares of our common

stock having a then-current value of twice the exercise price of the right.

If, after the rights become exercisable, we agree to merge into another

entity or we sell more than 50% of our assets, each right will entitle the

holder to purchase, at a price equal to the exercise price of the right, a

number of shares of common stock of such entity having a then-current

value of twice the exercise price.

We may exchange the rights at a ratio of one share of common stock

for each right (other than the Acquiring Person) at any time after an

Acquiring Person acquires 20% or more of our common stock but before

such person acquires 50% or more of our common stock. We may also

redeem the rights at our option at a price of $0.001 per right at any time

before an Acquiring Person has acquired 20% or more of our common

stock. The rights will expire on August 12, 2008.

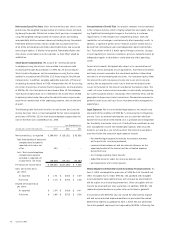

Note 12. Employee Benefits

401(k) Plan We maintain a salary deferral 401(k) plan for all of our

domestic employees. This plan allows employees to contribute up to

20% of their pretax salary up to the maximum dollar limitation pre-

scribed by the Internal Revenue Code. We match 100% of the first $500

of employees’ contributions and then 50% of the employees’ contribu-

tion. The maximum employer match in any given plan year is 3% of the

employees’ eligible compensation. Our contributions under the plan

were approximately $3.9 million, $4.1 million and $3.0 million during

fiscal 2003, 2002 and 2001.

Restricted Shares During fiscal 1999, we issued 200,000 restricted

shares to our current CEO for a purchase price of $0.005 per share,

vesting 50% at each anniversary date, with the first anniversary date

being April 14, 2000. Unearned compensation equivalent to the market

value of the common stock on the date of grant, less par, was charged to

stockholders’ equity and was amortized into compensation expense on a

straight-line basis over the vesting term. As of March 31, 2003, there

were 200,000 shares fully vested and outstanding.

Stock Purchase Plans In September 2002, our stockholders approved

the 2002 Executive Officers’ Stock Purchase Plan and reserved 250,000

shares of common stock for issuance. The purpose of the plan is to pro-

vide executive officers with a convenient means to acquire an equity

interest in Symantec at fair market value by applying a portion or all of

their respective bonus payments towards the purchase price. Each exec-

utive officer may purchase up to 10,000 shares in any fiscal year. As of

March 31, 2003, no shares have been issued under the plan.

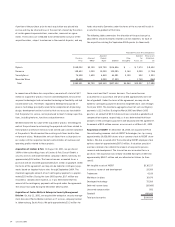

In September 1998, our stockholders approved the 1998 Employee

Stock Purchase Plan and reserved a total of 1.0 million shares of com-

mon stock for issuance. The plan was subsequently amended by our

stockholders on September 15, 1999, to increase the shares available

for issuance by approximately 1.5 million shares and to add an “ever-

green” provision whereby the number of shares available for issuance

increases automatically on January 1 of each year (beginning in 2000)

by 1% of our outstanding shares of common stock on each immediately

preceding December 31 during the term of the plan, provided that the

aggregate number of shares issued over the term of the plan does not

exceed 16.0 million shares. A total of approximately 8.1 million shares

of common stock has been reserved under the plan including an auto-

matic increase of approximately 1.5 million, 1.4 million, 1.5 million and

1.2 million shares on January 1, 2003, 2002, 2001, and 2000 respec-

tively. Subject to certain limitations, our employees may purchase,

through payroll deductions of 2% to 10% of their compensation, shares

of common stock at a price per share that is the lesser of 85% of the

fair market value as of the beginning of the offering period or the end of

the purchase period. As of March 31, 2003, approximately 2.6 million

shares had been issued and 5.5 million shares remain available under

the plan.

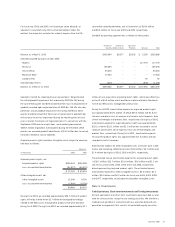

Stock Award Plans In September 2000, our stockholders approved

the 2000 Directors Equity Incentive Plan and reserved 50,000 shares of

common stock for issuance under this plan. The purpose of this plan is

to provide the members of the Board of Directors with an opportunity

to receive common stock for all or a portion of the retainer payable to

each director for serving as a member. Each director may elect to

receive 50% to 100% of the retainer to be paid in the form of stock. As

of March 31, 2003, a total of approximately 22,000 shares had been

issued under this plan.

In January 1995, the Board of Directors approved the terms of the 1994

Patent Incentive Plan. The purpose of this plan is to increase awareness

of the importance of patents to our business and to provide employees

with incentives to pursue patent protection for new technologies that

may be valuable to us. Our executive officers are not eligible for awards

under the 1994 Patent Incentive Plan, and no employee is eligible to

receive more than 100,000 shares of common stock at any time during

the term of the plan. The Board of Directors reserved 800,000 shares of

common stock for issuance under this plan. As of March 31, 2003, a

total of approximately 59,000 shares had been issued under this plan.

Stock awards issued under these stock award plans are recorded as

compensation expense.