Symantec 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Symantec 2003

Net Income (Loss) Per Share Basic net income (loss) per share is com-

puted using the weighted average number of common shares outstand-

ing during the periods. Diluted net income (loss) per share is computed

using the weighted average number of common shares outstanding

and potentially dilutive common shares outstanding during the periods.

Potentially dilutive common shares include the assumed conversion

of all of the outstanding convertible subordinated notes and assumed

exercising of options, if dilutive in the period. Potentially dilutive com-

mon shares are excluded in net loss periods, as their effect would be

antidilutive.

Stock-Based Compensation We account for stock-based awards

to employees using the intrinsic value method in accordance with

Accounting Principles Board Opinion, or APB, No. 25, Accounting for

Stock Issued to Employees, and to nonemployees using the fair value

method in accordance with SFAS No. 123, Accounting for Stock-Based

Compensation. In addition, we apply applicable provisions of Financial

Accounting Standards Board, or FASB, Interpretation No. 44, Accounting

for Certain Transactions Involving Stock Compensation, an interpretation

of APB No. 25. Our stock plans are described in Note 12. No employee

stock-based compensation cost is reflected in net income (loss) related

to options granted under those plans for which the exercise price was

equal to the market value of the underlying common stock on the date

of grant.

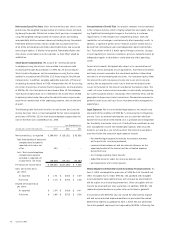

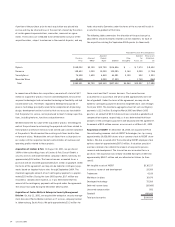

The following table illustrates the effect on net income (loss) and net

income (loss) per share as if we had applied the fair value recognition

provisions of SFAS No. 123 to stock-based employee compensation for

each of the three years ended March 31, 2003:

Year Ended March 31,

(IN THOUSANDS, EXCEPT PER SHARE DATA) 2003 2002 2001

Net income (loss), as reported $248,438 $(28,151) $ 63,936

Add: Amortization of unearned

compensation included in

reported net income, net

of tax 253 ––

Less: Stock-based employee

compensation expense

excluded in reported net

income (loss), net of tax (89,036) (79,141) (56,680)

Pro forma net income (loss) $159,655 $(107,292) $ 7,256

Basic net income (loss)

per share:

As reported $1.71 $(0.20) $ 0.49

Pro forma $1.15 $(0.75) $ 0.06

Diluted net income (loss)

per share:

As reported $1.54 $(0.20) $ 0.47

Pro forma $1.06 $(0.75) $ 0.06

Concentrations of Credit Risk Our product revenues are concentrated

in the software industry, which is highly competitive and rapidly chang-

ing. Significant technological changes in the industry or customer

requirements, or the emergence of competitive products with new

capabilities or technologies, could adversely affect operating results. In

addition, a significant portion of our revenues and net income (loss) is

derived from international sales and independent agents and distribu-

tors. Fluctuations of the U.S. dollar against foreign currencies, changes

in local regulatory or economic conditions, piracy or nonperformance by

independent agents or distributors could adversely affect operating

results.

Financial instruments that potentially subject us to concentrations of

credit risk consist principally of cash equivalents, short-term investments

and trade accounts receivable. Our investment portfolio is diversified

and consists of investment grade securities. Our investment policy limits

the amount of credit risk exposure to any one issuer and in any one

country. We are exposed to credit risks in the event of default by the

issuers to the extent of the amount recorded on the balance sheet. The

credit risk in our trade accounts receivable is substantially mitigated by

our credit evaluation process, reasonably short collection terms and the

geographical dispersion of sales transactions. We maintain reserves for

potential credit losses and such losses have been within management’s

expectations.

Legal Expenses We accrue estimated legal expenses for lawsuits only

when both of the conditions of SFAS No. 5, Accounting for Contingencies,

are met. Costs for external attorney fees are accrued when the likeli-

hood of the incurrence of the related costs is probable and management

has the ability to estimate such costs. If both of these conditions are not

met, management records the related legal expenses when incurred.

Amounts accrued by us are not discounted. The material assumptions

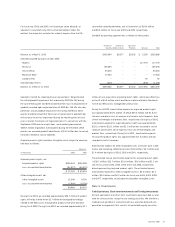

used to estimate the amount of legal expenses include:

•the monthly legal expense incurred by our external attorneys

on the particular case being evaluated;

•communication between us and our external attorneys on the

expected duration of the lawsuit and the estimated expenses

during that time;

•our strategy regarding these lawsuits;

•deductible amounts under our insurance policies; and

•past experiences with similar lawsuits.

Newly Adopted and Recently Issued Accounting Pronouncements On

April 1, 2002, we adopted the provisions of SFAS No. 142, Goodwill and

Other Intangible Assets. Under SFAS No. 142, goodwill and intangible

assets deemed to have indefinite lives will no longer be amortized but

will be subject to an annual impairment test. Other intangibles will con-

tinue to be amortized over their useful lives. In addition, SFAS No. 142

required acquired workforce-in-place to be reclassified as goodwill.

In accordance with SFAS No. 142, we ceased the amortization of good-

will and recharacterized acquired workforce-in-place (and the related

deferred tax liability) as goodwill on April 1, 2002. We also performed

the initial goodwill impairment test required by SFAS No. 142 during the