Symantec 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 Symantec 2003

American support group to Springfield, Oregon. As a result, we recorded

approximately $17.8 million for exit costs, including $12.8 million in

rent and related exit costs remaining on the abandoned facilities and

$5.0 million in related abandoned fixed asset and leasehold improve-

ment write-offs. In addition, we recorded approximately $2.6 million for

costs of severance, related benefits and outplacement services, as we

reorganized various operating functions, including former AXENT opera-

tions, and terminated 87 employees.

During fiscal 2001, we reorganized various operating functions, includ-

ing a portion of our operations in Toronto. We terminated 60 employees

and ten members of our senior management, and as a result, we

recorded approximately $3.7 million for costs of severance, related ben-

efits, outplacement services and abandonment of certain equipment.

LITIGATION JUDGMENT

During the March 2002 quarter, we accrued litigation expenses of

approximately $3.1 million for post-judgment interest and other costs

related to a judgment by a Canadian court on a decade-old copyright

action assumed by us as a result of our acquisition of Delrina

Corporation. There was no corresponding accrual during fiscal 2003

or fiscal 2001.

OPERATING INCOME

Operating income was approximately $341.5 million, $8.0 million and

$109.6 million during fiscal 2003, 2002 and 2001, respectively. The

primary factor in the increase between fiscal 2002 and 2003 was our

adoption of SFAS No. 142. As a result, in fiscal 2003, we recorded no

amortization of goodwill, compared with a charge of $196.8 million dur-

ing fiscal 2002. In addition, strength in major foreign currencies during

fiscal 2003, as compared to the average major foreign currency rates

during fiscal 2002, positively impacted our operating income growth by

approximately $19.9 million. Weakness in major foreign currencies dur-

ing fiscal 2002, as compared to the average major foreign currency rates

during fiscal 2001, negatively impacted our operating income growth

by approximately $12.1 million. We are unable to predict the extent to

which operating income in future periods will be impacted by changes

in foreign currency rates.

INTEREST INCOME, INTEREST EXPENSE AND OTHER EXPENSE, NET

Interest income was approximately $37.7 million, $31.7 million and

$33.3 million during fiscal 2003, 2002 and 2001, respectively. The

increase was due to higher average invested cash balances during fiscal

2003 as compared to fiscal 2002. Although interest income was rela-

tively flat during fiscal 2002 and fiscal 2001, average cash balances

were higher during fiscal 2002 as compared to fiscal 2001, which was

offset by a decrease in average interest rates.

Interest expense was approximately $21.2 million and $9.2 million dur-

ing fiscal 2003 and 2002, respectively, nearly all of which was related to

the issuance of $600.0 million of 3% convertible subordinated notes in

October 2001. Interest expense was not significant during fiscal 2001.

Other expense, net of approximately $1.3 million and $0.6 million

during fiscal 2003 and 2002, respectively, was primarily comprised of

net losses from non-functional currency transactions. Other expense,

net was approximately $22.5 million during fiscal 2001 and consisted

primarily of impairment charges on our equity investments.

INCOME, NET OF EXPENSE, FROM SALE OF TECHNOLOGIES AND

PRODUCT LINES

Income, net of expense, from sale of technologies and product lines was

approximately $6.9 million, $15.5 million and $20.4 million during fiscal

2003, 2002 and 2001, respectively. During fiscal 2003, 2002 and 2001,

income, net of expense, from sale of technologies and product lines was

related primarily to royalty payments received, in connection with the

divestiture of our ACT! product line in December 1999, from Interact

Commerce Corporation, which subsequently merged with The Sage

Group plc. During fiscal 2003, this royalty income was offset by the

write-off of approximately $2.7 million of developed technology related

to the Web access management products that were divested in the

September 2001 quarter.

INCOME TAXES

Our effective tax rate on income before taxes was approximately 32%,

162% and 55% during fiscal 2003, 2002 and 2001, respectively. The

higher effective tax rate in fiscal 2002 and 2001 reflects the non-

deductibility of acquired in-process research and development and

substantially all of the goodwill amortization.

Realization of our net deferred tax asset at March 31, 2003 is depend-

ent primarily upon future U.S. taxable income and our implementation

of tax planning strategies. We believe it is more likely than not that the

net deferred tax assets will be realized based on historical earnings and

expected levels of future taxable income as well as the implementation

of tax planning strategies.

Levels of future taxable income are subject to the various risks and

uncertainties discussed in the Business Risk Factors. An additional valu-

ation allowance against net deferred tax assets may be necessary if it is

more likely than not that all or a portion of the net deferred tax assets

will not be realized. We will assess the need for an additional valuation

allowance on a quarterly basis.

We project our effective tax rate to be 32% for fiscal 2004. This projec-

tion, however, is subject to change due to potential tax law changes and

fluctuations in the geographic distribution of earnings.

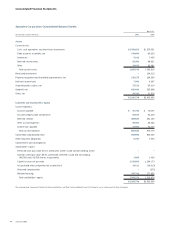

LIQUIDITY AND CAPITAL RESOURCES

Our principal source of liquidity is our cash, cash equivalents and short-

term investments as well as the cash that we generate over time from

our operations. Cash, cash equivalents and short-term investments

increased $330.6 million to approximately $1.7 billion at the end of

fiscal 2003 from $1.4 billion at the end of fiscal 2002. This increase is

primarily due to cash provided by operations, net proceeds from the