Symantec 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Symantec 2003 47

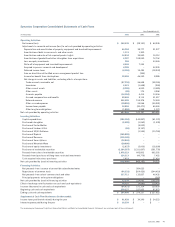

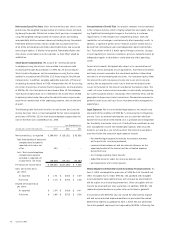

Symantec Corporation Consolidated Statements of Cash Flows

Year Ended March 31,

(IN THOUSANDS) 2003 2002 2001

Operating Activities:

Net income (loss) $248,438 $(28,151) $ 63,936

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Depreciation and amortization of property, equipment and leasehold improvements 56,794 38,777 31,977

Amortization of debt issuance costs and other assets 1,313 1,300 –

Amortization and write-off of acquired product rights 34,834 33,840 16,112

Amortization of goodwill and other intangibles from acquisitions 2,787 198,950 72,752

Loss on equity investments 750 –24,226

Write-off of equipment and leasehold improvements 4,569 7,232 –

Acquired in-process research and development 4,700 –22,300

Deferred income taxes (4,393) 13,482 (18,333)

Gain on divestiture of the Web access management product line –(392) –

Income tax benefit from stock options 39,550 46,230 8,386

Net change in assets and liabilities, excluding effects of acquisitions:

Trade accounts receivable, net (47,732) 26,628 (48,165)

Inventories 2,223 (1,638) (390)

Other current assets (4,728) 6,000 (4,585)

Other assets (65) 174 3,368

Accounts payable (14,304) 4,414 14,556

Accrued compensation and benefits 29,663 8,112 21,517

Deferred revenue 222,580 152,376 72,594

Other accrued expenses (10,018) 23,066 (26,391)

Income taxes payable 18,896 (20,471) 69,490

Other long-term obligations (1,952) 1,268 1,173

Net cash provided by operating activities 583,905 511,197 324,523

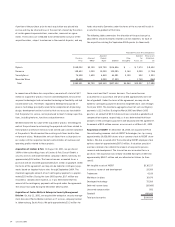

Investing Activities:

Capital expenditures (192,194) (140,857) (61,172)

Purchased intangibles (2,200) (1,060) (1,500)

Purchase of Foster-Melliar –(2,000) –

Purchase of Lindner & Pelc (59) (2,137) –

Purchase of 20/20 Software –(1,535) (10,760)

Purchase of Riptech (145,000) ––

Purchase of Recourse (135,320) ––

Purchase of SecurityFocus (74,932) ––

Purchase of Mountain Wave (20,000) ––

Purchase of equity investments (2,837) (3,000) (18,000)

Purchases of marketable securities (2,394,557) (1,311,697) (591,776)

Proceeds from sales of marketable securities 2,078,323 642,802 662,592

Proceeds from (purchases of) long-term restricted investments 124,313 (49,779) 7,422

Cash acquired in business purchases 7,823 –37,414

Net cash provided by (used in) investing activities (756,640) (869,263) 24,220

Financing Activities:

Net proceeds from issuance of convertible subordinated notes –584,625 –

Repurchases of common stock (64,332) (204,420) (244,410)

Net proceeds from sale of common stock and other 137,711 133,857 46,432

Principal payments on long-term obligations ––(363)

Net cash provided by (used in) financing activities 73,379 514,062 (198,341)

Effect of exchange rate fluctuations on cash and cash equivalents 14,725 (4,682) (10,452)

Increase (decrease) in cash and cash equivalents (84,631) 151,314 139,950

Beginning cash and cash equivalents 379,237 227,923 87,973

Ending cash and cash equivalents $294,606 $379,237 $ 227,923

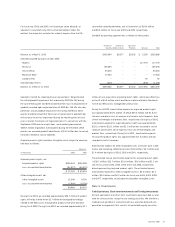

Supplemental Cash Flow Disclosures (in thousands):

Income taxes paid (net of refunds) during the year $61,628 $34,240 $ 24,223

Interest expense paid during the year $18,350 $–$–

The accompanying Summary of Significant Accounting Policies and Notes to Consolidated Financial Statements are an integral part of these statements.