Symantec 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 Symantec 2003

A portion of the purchase price for each acquisition was placed into

escrow and may be returned to us in the event of a breach by the sellers

of certain general representations, warranties, covenants or agree-

ments. The escrows are scheduled to be settled within one year of the

acquisition dates, subject to extension in the event of disputes, and any

funds returned to Symantec under the terms of the escrow will result in

a reduction to goodwill at that time.

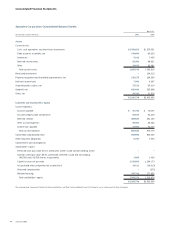

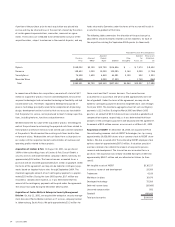

The following table summarizes the allocation of the purchase price,

adjusted for revised estimates related to certain liabilities, for each of

the acquisitions during the September 2002 quarter (in thousands):

In connection with these four acquisitions, we wrote off a total of $4.7

million of acquired in-process research and development, because the

acquired technologies had not reached technological feasibility and had

no alternative uses. The efforts required to develop the acquired in-

process technology principally relate to the completion of all planning,

design, development and test activities that are necessary to establish

that the product or service can be produced to meet its design specifica-

tions, including features, functions and performance.

We determined the fair value of the acquired in-process technology for

each of the purchases by estimating the projected cash flows related to

these projects and future revenues to be earned upon commercialization

of the products. We discounted the resulting cash flows back to their

net present values. We based the net cash flows from such projects on

our analysis of the respective markets and estimates of revenues and

operating profits related to these projects.

Acquisition of Lindner & Pelc On August 30, 2001, we purchased

100% of the outstanding shares of Lindner & Pelc Consult GmbH, a

security services and implementation company in Berlin, Germany, for

approximately $2.2 million. The transaction was accounted for as a

purchase and we recorded approximately $2.1 million in goodwill. Under

the terms of the agreement, we may also be liable for contingency pay-

ments based on targeted future sales through September 2004. The

maximum aggregate amount of such contingency payments is approxi-

mately $2.0 million. During the June 2002 quarter, $0.7 million was

recorded as compensation expense, as it was determined that this

amount of the contingency payments will be paid under the agreement.

The amount was paid during the December 2002 quarter.

Acquisition of Foster-Melliar’s Enterprise Security Management

Division On July 11, 2001, we acquired the enterprise security manage-

ment division of Foster-Melliar Limited, an IT services company located

in Johannesburg, South Africa. We paid approximately $1.5 million for

these assets and the IT services business. The transaction was

accounted for as a purchase and we recorded approximately $1.5 mil-

lion of goodwill. Under the terms of the agreement, we may also be

liable for contingency payments based on targeted future sales through

fiscal year 2004. The maximum aggregate amount of such contingency

payments is $1.5 million. During the March 2003 and March 2002

quarters, an amount of $0.5 million each was recorded as goodwill and

compensation expense, respectively, as it was determined that these

amounts of the contingency payments will be paid under the agreement.

An amount of $0.5 million remains as an accrual as of March 31, 2003.

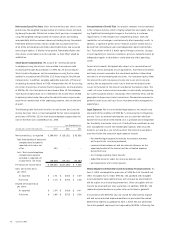

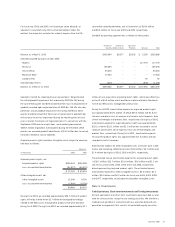

Acquisition of AXENT On December 18, 2000, we acquired 100% of

the outstanding common stock of AXENT Technologies, Inc. by issuing

approximately 29,056,000 shares of our common stock to AXENT share-

holders. We also assumed all of the outstanding AXENT employee stock

options valued at approximately $87.0 million. A valuation specialist

used our estimates to establish the amount of acquired in-process

research and development. The transaction was accounted for as a

purchase. The acquisition was initially recorded during fiscal 2001 for

approximately $924.7 million and was allocated as follows (in thou-

sands):

Net tangible assets of AXENT $130,517

In-process research and development 22,300

Tradename 4,100

Workforce-in-place 10,670

Developed technology 75,500

Deferred income taxes (19,080)

Unearned compensation 992

Goodwill 699,660

Total purchase price $924,659

Allocated Purchase Price Components

Acquired Deferred Other assets

Purchase Acquired Product Other Tax (Liabilities),

Price IPR&D Rights Goodwill Intangibles Assets, net net

Riptech $148,032 $2,100 $12,700 $116,836 $ – $ 7,974 $ 8,422

Recourse 138,633 1,000 19,000 109,085 2,164 9,090 (1,706)

SecurityFocus 76,558 1,600 6,840 64,281 2,100 503 1,234

Mountain Wave 20,698 – 2,000 17,320 – 1,740 (362)

Total $383,921 $4,700 $40,540 $307,522 $4,264 $19,307 $ 7,588