Symantec 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Symantec 2003

Principles of Consolidation The accompanying consolidated financial

statements include the accounts of Symantec Corporation and its wholly

owned subsidiaries. All significant intercompany accounts and transac-

tions have been eliminated.

Acquisitions and Divestitures During the three years ended March 31,

2003, we acquired:

•Riptech, Inc., Recourse Technologies, Inc., SecurityFocus Inc.,

and Mountain Wave, Inc. in the September 2002 quarter;

•Lindner & Pelc Consult GmbH and Foster-Melliar Limited’s

enterprise security management division in the September 2001

quarter; and

•AXENT Technologies, Inc. in the December 2000 quarter.

Each of these acquisitions was accounted for as a purchase and, accord-

ingly, their operating results have been included in our consolidated

financial statements since their respective dates of acquisition.

We divested our Web access management product line on August 24,

2001. This product line is included in the results of operations prior to

disposition and is included in our Other segment.

Use of Estimates The preparation of financial statements in conformity

with generally accepted accounting principles requires management to

make estimates and assumptions that affect the amounts reported in

the consolidated financial statements and accompanying notes. Actual

results could differ from those estimates.

Foreign Currency Translation The functional currency of our foreign

subsidiaries is the local currency. Assets and liabilities denominated in

foreign currencies are translated using the exchange rate on the balance

sheet dates. The translation adjustments resulting from this process are

included as a component of stockholders’ equity in accumulated other

comprehensive income (loss). Revenues and expenses are translated

using average exchange rates prevailing during the year. Foreign cur-

rency transaction gains and losses are included in the determination of

net income (loss).

Revenue Recognition We derive revenue primarily from sales of pack-

aged products, perpetual license agreements, product maintenance and

services, and recognize this revenue in accordance with Statement of

Position, or SOP, 97-2, Software Revenue Recognition, as modified by

SOP 98-9, and Staff Accounting Bulletin No. 101, Revenue Recognition

in Financial Statements, when the following conditions have been met:

•persuasive evidence of an arrangement exists;

•passage of title occurs;

•delivery has occurred or services have been rendered;

•if applicable, customer acceptance has been received;

•collection of a fixed or determinable license fee is considered

probable; and

•if appropriate, reasonable estimates of future product returns

have been made.

We sell packaged products, which primarily include consumer products,

through a multi-tiered distribution channel. We defer revenue on all dis-

tribution and reseller channel inventory in excess of specified inventory

levels in these channels. We defer a portion of revenue for product bun-

dled with content updates. This deferred revenue is recognized ratably

over the initial year that such updates are provided. We offer the right

of return of our products under various policies and programs with our

distributors, resellers and end-user customers. We estimate and record

reserves for end-user product returns and channel and end-user

rebates, and we account for these reserves as an offset to revenue.

We enter into perpetual software license agreements mainly for our

enterprise security and enterprise administration products primarily

through indirect sales with distributors and resellers. The license agree-

ments generally include product maintenance agreements, for which the

related revenue is deferred and recognized ratably over the period of

the agreements.

Our services include managed security services, consulting and educa-

tion. We recognize managed security services revenue ratably over the

period that such contracted services are provided. We recognize con-

sulting services revenue as services are performed or upon written

acceptance from customers, if applicable. We recognize education

services revenue as services are performed.

In arrangements that include perpetual software licenses and mainte-

nance and/or services and packaged products with content updates

(“multiple elements”), we allocate and defer revenue for the undelivered

items based on vendor-specific objective evidence, or VSOE, of fair value

of the undelivered elements, and recognize the difference between the

total arrangement fee and the amount deferred for the undelivered

items as revenue. Our deferred revenue consists primarily of the

unamortized balance of enterprise product maintenance and consumer

product content updates.

VSOE of each element is based on the price for which the undelivered

element is sold separately. We determine fair value of the undelivered

elements based on historical evidence of our stand-alone sales of these

elements to third parties. If VSOE does not exist for undelivered items

such as maintenance or services, then the entire arrangement fee is

recognized ratably over the performance period.

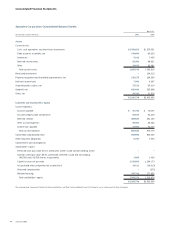

Cash Equivalents, Short-term Investments and Restricted

Investments We consider investments in highly liquid instruments

purchased with an original maturity of 90 days or less to be cash equiv-

alents. Primarily all of our cash equivalents and short-term investments

are classified as available-for-sale as of the balance sheet dates. These

securities are reported at fair market value and any unrealized gains

and losses are included as a component in stockholders’ equity in accu-

mulated other comprehensive income (loss). Realized gains and losses

and declines in value judged to be other than temporary on available-

for-sale securities are included in other expense, net. The cost of securi-

ties sold is based upon the specific identification method. Restricted

Summary of Significant Accounting Policies