Symantec 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Symantec 2003 55

During fiscal 2001, we also accrued approximately $18.3 million in

acquisition related expenses, which included financial advisory, legal

and accounting, duplicative site and fixed assets, and severance costs.

These acquisition related expenses were paid by the end of the

December 2001 quarter.

After filing the pre-acquisition tax returns of AXENT during the

December 2001 quarter, we identified additional tax losses and other

beneficial tax attributes available from the pre-acquisition periods of

AXENT. As a result, we recorded additional deferred tax assets of $5 mil-

lion attributable to these carryforward tax benefits, with a correspon-

ding offset to goodwill.

During the September 2001 quarter, we divested the Web access man-

agement product line that we acquired with our acquisition of AXENT.

As a result, we wrote off approximately $0.8 million of net workforce-

in-place related to this product line (see Divestiture of Web Access

Management Product Line).

During the June 2001 quarter, we resolved certain pre-acquisition

contingencies related to the acquisition of AXENT, and as a result, we

increased the purchase price and goodwill by $4.5 million. The amount

allocated to tradename, workforce-in-place, developed technology

and goodwill is being amortized over their useful lives of four years. In

accordance with SFAS No. 142, we recharacterized acquired workforce-

in-place (and the related deferred tax liability) as goodwill and ceased

the amortization of goodwill on April 1, 2002. The unearned compensa-

tion related to the options assumed as part of the acquisition is being

amortized over the remaining vesting period.

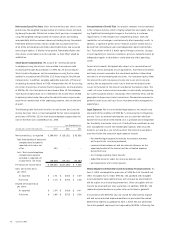

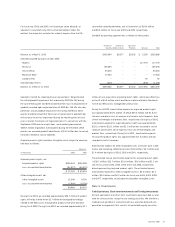

Pro Forma The following unaudited pro forma information for fiscal

2003, 2002 and 2001 was as if the Riptech acquisition had occurred at

the beginning of each fiscal period presented. The pro forma informa-

tion excludes approximately $1.7 million (pre-tax) of amortization

related to developed technology and other intangible assets associated

with the Riptech acquisition for fiscal 2003. In addition, the pro forma

information excludes approximately $2.1 million (pre-tax) of acquired

in-process research and development associated with the Riptech acqui-

sition for fiscal 2003. The pro forma information excludes approximately

$196.8 million (pre-tax) and $2.8 million (pre-tax) of amortization

related to goodwill and workforce-in-place, respectively, associated

with non-related acquisitions for fiscal 2002.

The pro forma information has been prepared for comparative purposes

only and is not indicative of what operating results would have been if

the acquisition had taken place at the beginning of fiscal 2002 or of

future operating results. Financial information prepared in accordance

with U.S. GAAP for Recourse was not available due to insufficient

record-keeping during the interim and annual periods in fiscal 2002

and interim periods in 2003 and, as such, has not been included in this

pro forma information. Pro forma information for SecurityFocus and

Mountain Wave was not presented, as the SecurityFocus and Mountain

Wave acquisitions were deemed not significant.

Year Ended March 31,

(IN THOUSANDS, EXCEPT NET INCOME PER SHARE DATA; UNAUDITED) 2003 2002

Net revenues $1,413,762 $1,080,093

Net income $244,117 $151,509

Basic net income per share $1.68 $1.06

Diluted net income per share $1.51 $0.99

Divestiture of the Web Access Management Product Line On August

24, 2001, we sold assets and transferred liabilities and employees

related to our Web access management product line to PassGo

Technologies, Ltd for approximately $1.1 million in cash, resulting in

a pre-tax gain of approximately $0.4 million on the divestiture, which

was recorded in income, net of expense, from sale of technologies and

product lines on the Consolidated Statements of Operations.

We also entered into an exclusive license and option agreement with

PassGo whereby they licensed our Web access management technology

products. In consideration for the license, PassGo is required to pay us

quarterly royalties based on their net revenue starting at 30% and

declining to 10% over a four-year period. Because the royalties are not

guaranteed and the quarterly amounts to be received are not deter-

minable until earned, we are recognizing these royalties as payments

are due. PassGo has an option to purchase the technology at a price

starting at $18.8 million and declining to $3.3 million over a four-year

period. These payments, if any, will be recorded in income, net of

expense, from sale of technologies and product lines.

During fiscal 2003 and 2002, we recorded approximately $1.8 million

and $1.1 million for the amortization of the developed technology

related to the Web access management products in income, net of

expense, from sale of technologies and product lines. During the

December 2002 quarter, we also wrote off approximately $2.7 million

of developed technology related to the Web access management prod-

ucts due to impairment.

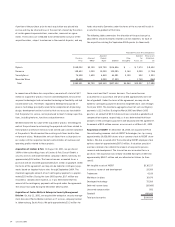

Divestiture of ACT! Product Line On December 31, 1999, we licensed

substantially all of the ACT! product line technology to Interact

Commerce Corporation for a period of four years. In addition, we sold

the inventory and fixed assets related to the ACT! product line to

Interact. In consideration for the license and assets, Interact transferred

to us 623,247 shares of its unregistered common stock, valued at

approximately $20.0 million. During the March 2001 quarter, Interact

entered into a plan to merge with The Sage Group plc and we recorded a

loss of approximately $12.5 million as other expense on the Condensed

Consolidated Statements of Operations related to the other than tempo-

rary decline in value of our investment in Interact. As a result of the

merger, we received approximately $7.5 million upon the surrender of

the Interact shares in July 2001.

In addition to the shares received from Interact, Interact is required to

pay us quarterly royalty payments for four years. Interact will pay these

royalties based on future revenues set forth in the license, up to an