Symantec 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 Symantec 2003

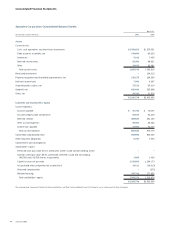

The following table displays our contractual obligations as of March 31, 2003:

Payments Due In

Total Fiscal 2005 Fiscal 2007 Fiscal 2009

(IN THOUSANDS) Payments Due Fiscal 2004 and 2006 and 2008 and Thereafter

Convertible subordinated notes $600,000 $ – $ – $600,000 $ –

Operating leases 105,674 31,306 43,105 23,972 7,291

Total contractual obligations $705,674 $31,306 $43,105 $623,972 $7,291

The above table assumes that the convertible subordinated notes will

be paid in cash upon maturity and excludes the balance of our current

liabilities.

We believe that existing cash and short-term investments, cash gener-

ated from operating results and cash from the subordinated convertible

debenture offering will be sufficient to fund operations for at least the

next year.

Newly Adopted and Recently Issued Accounting

Pronouncements

On April 1, 2002, we adopted the provisions of SFAS No. 142, Goodwill

and Other Intangible Assets. Under SFAS No. 142, goodwill and intangi-

ble assets deemed to have indefinite lives will no longer be amortized

but will be subject to an annual impairment test. Other intangibles will

continue to be amortized over their useful lives. In addition, SFAS No.

142 required acquired workforce-in-place to be reclassified as goodwill.

In accordance with SFAS No. 142, we ceased the amortization of good-

will and recharacterized acquired workforce-in-place (and the related

deferred tax liability) as goodwill on April 1, 2002. We also performed

the initial goodwill impairment test required by SFAS No. 142 during the

June 2002 quarter. We identified four reporting units, which represent

our primary operating segments, and determined that there was no

impairment of goodwill recorded upon implementation of SFAS No. 142.

We completed our annual goodwill impairment test during the March

2003 quarter and determined that there was no impairment of goodwill.

We will continue to test for impairment during the fourth quarter of

each year, or earlier if indicators of impairment exist.

As a result of the discontinuance of the amortization of goodwill existing

as of March 31, 2002, the application of SFAS No. 142 resulted in an

increase in our results of operations of approximately $198.4 million

during fiscal 2003. At March 31, 2003, we had goodwill of approxi-

mately $833.4 million.

On April 1, 2002, we adopted SFAS No. 144, Accounting for Impairment

or Disposal of Long-Lived Assets. SFAS No. 144 supersedes SFAS No.

121, Accounting for the Impairment of Long-Lived Assets and for Long-

Lived Assets to be Disposed Of and elements of APB No. 30, Reporting

the Results of Operations – Reporting the Effects of Disposal of a

Segment of a Business and Extraordinary, Unusual, and Infrequently

Occurring Events and Transactions. SFAS No. 144 addresses financial

accounting and reporting for the impairment and disposal of long-lived

assets. The adoption of this statement did not have a material impact

on our financial position or results of operations.

In June 2002, the FASB issued SFAS No. 146, Accounting for Costs

Associated with Exit or Disposal Activities. SFAS No. 146 requires that

the liability for a cost associated with an exit or disposal activity be rec-

ognized when the liability is incurred rather than when a commitment is

made to an exit or disposal plan. SFAS No. 146 also establishes that the

liability should initially be measured and recorded at fair value. SFAS

No. 146 became effective for exit or disposal activities that were initi-

ated after December 31, 2002. The adoption of this statement may

result in recognizing the cost of future restructuring activities, if any,

over a period of time rather than in the reporting period that the plan

of restructuring is adopted.

In November 2002, the FASB issued Interpretation No. 45, Guarantor’s

Accounting and Disclosure Requirements for Guarantees, Including

Indirect Guarantees of Indebtedness of Others. Under this Interpretation,

a liability shall be recognized for the fair value of the obligation under-

taken in issuing or modifying guarantees and indemnification agree-

ments after December 31, 2002. Certain of the software licenses that

we have granted contain provisions that indemnify licensees of the soft-

ware from damages and costs resulting from claims alleging that our

software infringes the intellectual property rights of a third party. We

have historically received only a limited number of requests for indemni-

fication under these provisions and have not been required to make

material payments pursuant to these provisions. Accordingly, we have

not recorded a liability related to these indemnification provisions.

As of March 31, 2003, we had no liability associated with any of our

indemnification agreements on our balance sheet.

In January 2003, the FASB issued Interpretation No. 46, Consolidation of

Variable Interest Entities, an Interpretation of ARB No. 51, that provides

guidance for determining when a primary beneficiary should consolidate

a variable interest entity that functions to support the activities of the

primary beneficiary. The effective date of Interpretation No. 46 is the

first interim period beginning after June 15, 2003 for variable interest

entities acquired before February 1, 2003 and immediately to variable

interest entities created after January 31, 2003. In the March 2003

quarter, we purchased four of our facilities that were classified as