Symantec 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 Symantec 2003

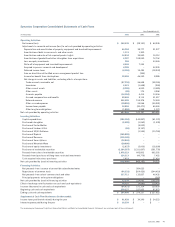

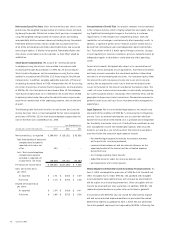

Symantec Corporation Consolidated Statements of Stockholders’ Equity

Notes

Capital in Receivable Accum Total

Common Excess of from Other Comp Unearned Retained Stockholders’

(IN THOUSANDS) Stock Par Value Stockholders Inc. (Loss) Compensation Earnings Equity

Balances, March 31, 2000 $ 603 $ 435,663 $(24) $(27,707) $(677) $210,099 $ 617,957

Components of comprehensive income:

Net income –––––63,936 63,936

Unrealized gain on available-for-sale securities – – – 2,987 – – 2,987

Translation adjustment – – – (24,152) – – (24,152)

Total comprehensive income 42,771

Issued common stock:

4,338 shares under stock plans 22 45,612 ––––45,634

29,056 shares to AXENT stockholders and assumption

of outstanding AXENT stock options 145 906,212 – – (992) – 905,365

Amortization of unearned compensation ––––774–774

Repayment of notes receivable from stockholder – – 24 – – – 24

Repurchased 10,000 shares of common stock (50) (216,198) – – – (28,162) (244,410)

Income tax benefit related to stock options – 8,386 ––––8,386

Balances, March 31, 2001 720 1,179,675 – (48,872) (895) 245,873 1,376,501

Components of comprehensive loss:

Net loss –––––(28,151) (28,151)

Unrealized gain on available-for-sale securities – – – 104 – – 104

Translation adjustment – – – (4,245) – – (4,245)

Total comprehensive loss (32,292)

Issued common stock:

9,187 shares under stock plans 61 133,281 – – – (8) 133,334

Stock dividend 703 ––––(703) –

Amortization of unearned compensation ––––523–523

Repurchased 9,640 shares of common stock (48) (165,013) – – – (39,359) (204,420)

Income tax benefit related to stock options – 46,230 ––––46,230

Balances, March 31, 2002 1,436 1,194,173 – (53,013) (372) 177,652 1,319,876

Components of comprehensive income:

Net income –––––248,438 248,438

Unrealized gain on available-for-sale securities,

net of tax expense of $820 – – – 1,023 – – 1,023

Translation adjustment – – – 82,111 – – 82,111

Total comprehensive income 331,572

Issued common stock:

7,449 shares under stock plans 74 137,265 ––––137,339

Amortization of unearned compensation ––––372–372

Repurchased 2,223 shares of common stock (22) (35,962) – – – (28,348) (64,332)

Conversion of convertible debt – 2 ––––2

Income tax benefit related to stock options – 39,550 ––––39,550

Balances, March 31, 2003 $1,488 $1,335,028 $ – $ 30,121 $ – $397,742 $1,764,379

The accompanying Summary of Significant Accounting Policies and Notes to Consolidated Financial Statements are an integral part of these statements.