Symantec 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 Symantec 2003

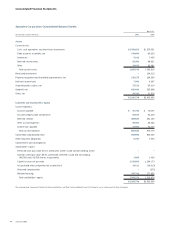

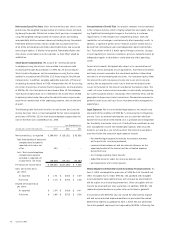

Hypothetical Fair Market Values Given an

Interest Rate Increase (Decrease) of X Basis Points (bps)

Investment and Debt Portfolios Fair Value (75 bps) (25 bps) 50 bps 100 bps 150 bps

USD Portfolios (in U.S. $) 762.9 767.1 764.3 760.1 757.3 754.6

EURO Portfolios (in EURO) 653.5 656.3 654.6 650.6 647.9 645.1

CAD Portfolios (in Canadian $) 188.0 188.4 188.1 187.7 187.4 187.1

Quantitative and Qualitative Disclosures about Market Risk

We are exposed to market risk related to fluctuations in market prices,

interest rates, and foreign currency exchange rates. We use certain

derivative financial instruments to manage these risks. All financial

instruments used are in accordance with our global investment policy

and global foreign exchange policy. We do not use derivative financial

instruments for trading purposes.

We also hold equity interests in six privately-held companies. These

investments were recorded at cost, and are classified as other long-term

assets on the Consolidated Balance Sheets. These investments are

inherently risky and we could lose our entire initial investment in these

companies. As of March 31, 2003, these investments had a carrying

value of approximately $10.5 million.

INTEREST RATE SENSITIVITY

We consider investments in highly liquid instruments purchased with

an original maturity of 90 days or less to be cash equivalents. All of our

cash equivalents and short-term investments are classified as available-

for-sale as of the balance sheet dates. These securities are reported at

fair market value and any unrealized gains and losses are included as a

component in stockholders’ equity in accumulated other comprehensive

income (loss). Our cash equivalents and short-term investments consist

primarily of corporate securities, taxable auction rate securities, U.S.

government and government-sponsored securities, money market funds

and asset backed securities.

The following table presents the fair value and hypothetical changes in

fair market values of the financial instruments held as of March 31,

2003 that are sensitive to changes in interest rates (in millions):

The modeling technique used above measures the change in fair mar-

ket value arising from selected potential changes in interest rates.

Market changes reflect immediate hypothetical parallel shifts in the

yield curve of minus 75 basis points, minus 25 basis points, plus 50

basis points, plus 100 basis points and plus 150 basis points, which

are representative of the movements in the United States Federal

Funds Rate, Euro Area ECB Rate and Canada Overnight Rate.

During October 2001, we issued $600.0 million of 3% convertible sub-

ordinated notes. The notes pay interest semi-annually and mature on

November 1, 2006. As of March 31, 2003, we had approximately

$600.0 million principal amount of notes outstanding.

EXCHANGE RATE SENSITIVITY

We conduct business in 30 international currencies through our world-

wide operations. We believe that the use of foreign exchange forward

contracts should reduce the risks that arise from conducting business

in international markets.

We hedge risks associated with certain foreign currency cash, invest-

ments, receivables and payables in order to minimize the impact of

changes in foreign currency fluctuations on these assets and liabilities

denominated in foreign currencies. Foreign exchange forward con-

tracts as of March 31, 2003 were as follows (in millions):

Resulting Increase (Decrease) in Future Value of

Foreign Forward Exchange Contracts Given X%

Appreciation (Devaluation) of Foreign Currency

Foreign Forward Notional

Exchange Contracts Amount 10% 5% (5)% (10)%

Purchased $ 0.9 $ 0.1 $ – $ – $ –

Sold 66.4 (6.0) (3.2) 3.5 7.4

We believe that these foreign exchange forward contracts do not subject

us to undue risk from the movement of foreign exchange rates because

gains and losses on these contracts are offset by losses and gains on the

underlying assets and liabilities. All contracts have a maturity of no

more than 35 days. Gains and losses are accounted for as other expense,

net each period. We regularly review our hedging program and may

make changes as a result of this review.