Symantec 2003 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Symantec 2003 57

Goodwill is tested for impairment on an annual basis. We performed

the initial goodwill impairment test required by SFAS No. 142 during

the June 2002 quarter and determined that there was no impairment of

goodwill recorded upon implementation of SFAS No. 142. We also com-

pleted our annual goodwill impairment test during the March 2003

quarter and determined that there was no impairment of goodwill. We

will continue to test for impairment during the fourth quarter of each

year, or earlier if indicators of impairment exist. In connection with the

September 2002 quarter acquisitions, we recorded approximately

$308.7 million of goodwill. Subsequently during the December 2002

quarter, we recorded goodwill adjustments of $1.2 million due to revised

estimates related to certain liabilities.

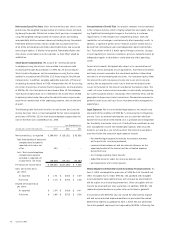

Acquired product rights and other intangible assets subject to amortiza-

tion were as follows:

March 31,

(IN THOUSANDS) 2003 2002

Acquired product rights, net:

Acquired product rights $165,642 $125,589

Less: accumulated amortization (92,517) (60,370)

$73,125 $65,219

Other intangible assets, net:

Other intangible assets 12,300 9,700

Less: accumulated amortization (7,496) (4,709)

$4,804 $4,991

During fiscal 2003, we recorded approximately $42.7 million of product

rights, offset by a write-off of $2.7 million of developed technology

related to the Web access management products that were divested

during fiscal 2002. During fiscal 2002, we recorded approximately $1.1

million of non-acquisition acquired product rights, which was offset by a

write-off of $0.8 million of net workforce-in place related to the divesti-

ture of our Web access management product line.

During fiscal 2003, amortization expense for acquired product rights

was approximately $32.1 million, of which $30.4 million and $1.8 mil-

lion was recorded in cost of revenues and income, net of expense, from

sale of technologies and product lines, respectively. During fiscal 2002,

amortization expense for acquired product rights was approximately

$32.2, of which $31.1 million and $1.1 million was recorded in cost of

revenues and income, net of expense, from sale of technologies and

product lines, respectively. During fiscal 2001, amortization expense

for acquired product rights was approximately $17.3 million and was

recorded in cost of revenues.

Amortization expense for other intangible assets (customer base, trade-

names and marketing-related assets) was $2.8 million, $2.1 million and

$1.4 million during fiscal 2003, 2002 and 2001, respectively.

The estimated annual amortization expense for acquired product rights

is $32.7 million, $23.7 million, $10.0 million, $5.6 million and $1.1 mil-

lion for fiscal year 2004, 2005, 2006, 2007 and 2008, respectively,

based upon existing acquired product rights. The estimated annual

amortization expense for other intangible assets is $2.6 million, $1.5

million, $0.5 million and $0.2 million for fiscal year 2004, 2005, 2006

and 2007, respectively, based upon existing other intangible assets.

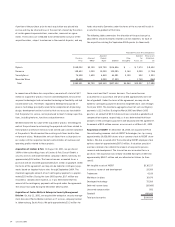

Note 5. Investments

Cash Equivalents, Short-term Investments and Trading Investments

All cash equivalents and short-term investments were classified as avail-

able-for-sale securities, except for our trading securities. We maintain a

trading asset portfolio in connection with our executive deferred com-

pensation arrangements that consists of marketable equity securities,

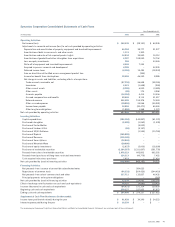

Enterprise Enterprise Consumer

Security Administration Products Services Total

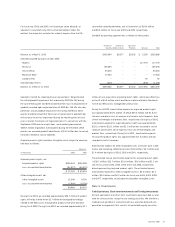

Balance, as of April 1, 2002 $505,960 $8,377 $9,332 $ 2,199 $525,868

Goodwill acquired during fiscal year 2003:

Riptech –––117,770 117,770

Recourse 109,265 – – – 109,265

SecurityFocus 64,318 – – – 64,318

Mountain Wave 17,320 – – – 17,320

Lindler & Pelc –––5959

Goodwill adjustments (217) – – (934) (1,151)

Balance, as of March 31, 2003 $696,646 $8,377 $9,332 $119,094 $833,449

For fiscal year 2003 and 2002, net income per share (diluted), as

adjusted is calculated using the if-converted method. Under this

method, the numerator excludes the interest expense from the 3%

convertible subordinated notes, net of income tax, of $14.4 million

and $6.2 million for fiscal year 2003 and 2002, respectively.

Goodwill by operating segment was as follows (in thousands):