Symantec 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Symantec 2003 61

Stock Option Plans We maintain stock option plans pursuant to which

an aggregate total of approximately 83.0 million shares of common

stock have been reserved for issuance as incentive and nonqualified

stock options to employees, officers, directors, consultants, independ-

ent contractors and advisors to us, or of any parent, subsidiary or affili-

ate of Symantec as the Board of Directors or committee may determine.

The purpose of these plans is to attract, retain and motivate eligible

persons whose present and potential contributions are important to

our success by offering them an opportunity to participate in our future

performance through awards of stock options and stock bonuses. Under

the terms of these plans, the option exercise price may not be less than

100% of the fair market value on the date of grant and the options

have a maximum term of ten years and generally vest over a four-year

period.

In January 2001, the Board of Directors approved the terms of the 2001

Non-Qualified Equity Incentive Plan, under which we grant options to

employees, officers, directors, consultants, independent contractors and

advisors to us, or of any parent, subsidiary or affiliate of Symantec as

the Board of Directors or committee may determine. Options awarded

to insiders, defined as officers, directors or other persons subject to

Section 16 of the Securities Exchange Act of 1934, may not exceed in

the aggregate fifty (50%) percent of all shares that are available for

grant under the plan and employees of the company who are not insid-

ers must receive at least fifty (50%) percent of all shares that are avail-

able for grant under the plan. The terms of this plan are similar to those

of our 1996 Equity Incentive Plan, except that it was adopted, and may

be amended, without stockholder approval. The Board of Directors

reserved 6.0 million shares of common stock for issuance under the

plan. As of March 31, 2003, approximately 1.7 million options were

outstanding under this plan.

In December 2000, as a result of our acquisition of AXENT, we assumed

all outstanding AXENT stock options. Each AXENT stock option assumed

by us is exercisable for one share of Symantec common stock for each

one share of AXENT common stock that was previously subject to the

option, at the same exercise price. Each option is otherwise subject to

the same terms and conditions as the original grant and generally vests

over four years and expires ten years from the date of grant. No further

options may be granted under the AXENT plans. As of March 31, 2003,

approximately 452,000 options were outstanding.

In July 1999, the Board of Directors approved the terms of the 1999

Acquisition Plan. Options awarded to officers may not exceed in the

aggregate thirty (30%) percent of all shares that are available for grant

under the plan. The terms of this plan are similar to those of our 1996

Equity Incentive Plan, except that it was adopted, and may be amended,

without stockholder approval. The Board of Directors reserved 1.0 mil-

lion shares of common stock for issuance under the plan. As of March

31, 2003, approximately 213,000 options were outstanding under this

plan.

In accordance with the employment agreement dated April 11, 1999

between our current CEO and Symantec, the Board of Directors

approved the issuance of a non-qualified stock option to acquire

400,000 shares of common stock to the CEO. The option was granted

at 100% of the fair market value on the date of grant, has a term life

of ten years and vests over a five-year period. As of March 31, 2003, all

400,000 options were outstanding.

On December 20, 1999 a non-qualified option to acquire 40,000 shares

was approved for grant to the CEO and was deemed granted on January

1, 2000. The option was granted at 100% of the fair market value on

the date of grant, has a term life of ten years and vests 25% on the first

anniversary of the date of grant and 2.0833% each month thereafter.

As of March 31, 2003, all 40,000 options were outstanding.

In May 1996, our stockholders approved the 1996 Equity Incentive Plan

and subsequently approved amendments to increase the number of

shares of common stock reserved for issuance under the plan to a total

of approximately 48.9 million shares, including approximately 6.4 mil-

lion, 7.2 million and 4.8 million shares approved on September 12,

2002, September 12, 2001 and December 15, 2000, respectively. As of

March 31, 2003, approximately 20.7 million options were outstanding

under this plan.

As of March 31, 2003, of the approximately 24.6 million shares reserved

under the 1988 Employee Stock Option Plan, which was superseded by

the 1996 Equity Incentive Plan, approximately 111,000 options remain

outstanding. Furthermore, of the 900,000 shares reserved under the

1993 Directors Stock Option Plan, 31,000 options remain outstanding.

No further options may be granted under these plans.

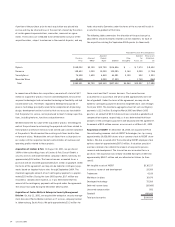

Stock option activity was as follows:

Weighted

Average

Exercise

(IN THOUSANDS, EXCEPT WEIGHTED Number Price Per

AVERAGE EXERCISE PRICE PER SHARE) of Shares Share

Outstanding as of March 31, 2000 20,038 $16.34

Granted 18,334 19.57

Exercised (3,542) 10.30

Canceled (3,102) 20.88

Outstanding as of March 31, 2001 31,728 18.43

Granted 8,450 30.26

Exercised (8,254) 14.56

Canceled (3,140) 20.67

Outstanding as of March 31, 2002 28,784 22.77

Granted 3,548 36.12

Exercised (6,390) 18.92

Canceled (2,323) 26.83

Outstanding as of March 31, 2003 23,619 $25.42