Symantec 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 Symantec 2003

aggregate maximum of $57.0 million. Because the royalties are not

guaranteed and the quarterly amounts to be received are not deter-

minable until earned, we are recognizing these royalties as payments

are due. We recorded approximately $10.5 million, $15.5 million and

$19.3 million of royalty payments during fiscal 2003, 2002 and 2001,

respectively, in income, net of expense, from sale of technologies and

product lines. At the end of the four-year period, Interact has the exclu-

sive option, for a period of 30 days, to purchase the licensed technology

from us for $60 million less all royalties paid to us to date.

Other Royalties and Transition Fees In accordance with individual

transition agreements, PassGo and Interact paid us royalties and/or fees

for invoicing, collecting receivables, shipping and other operational and

support activities. We recorded approximately $0.8 million, $0.7 million

and $0.8 million for these royalties and/or fees during fiscal 2003, 2002

and 2001, respectively, in income, net of expense, from sale of technolo-

gies and product lines.

Divestiture of Electronic Forms During September 1996, we sold our

electronic forms software product line and related tangible assets to

JetForm Corporation, payable in installments through the June 2000

quarter. We received installment payments from JetForm of approxi-

mately $0.4 million during fiscal 2001. Due to the uncertainty regarding

the ultimate collectibility of these installments, we recognized the

related amounts as payments were due and collectibility was assured

from JetForm. Installment payments from JetForm were recorded in

income, net of expense, from sale of technologies and product lines.

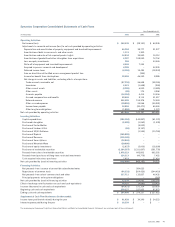

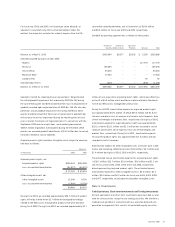

The components of income, net of expense, from sale of technologies

and product lines were as follows:

Year Ended March 31,

(IN THOUSANDS) 2003 2002 2001

Royalties from Interact $10,500 $15,500 $19,250

Gain on divestiture of Web access

management product line –392 –

Amortization and write-off of

developed technology related

to Web access management

product line (4,462) (1,050) –

Other royalties and transition fees 840 694 801

Payments from JetForm ––397

Income, net of expense, from sale

of technologies and product lines $6,878 $15,536 $20,448

Note 4. Goodwill, Acquired Product Rights and Other

Intangible Assets

With the adoption of SFAS No. 142, we ceased the amortization of good-

will and recharacterized acquired workforce-in-place (and the related

deferred tax liability) as goodwill on April 1, 2002. Accordingly, there

was no amortization of goodwill and acquired workforce-in-place during

fiscal 2003.

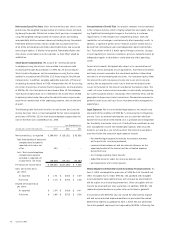

The following table presents a reconciliation of previously reported net

income (loss) and net income (loss) per share to the amounts adjusted

for the exclusion of the amortization of goodwill and acquired work-

force-in-place, net of the related income tax effect:

Year Ended March 31,

(IN THOUSANDS, EXCEPT PER SHARE DATA) 2003 2002 2001

Net income (loss), as reported $248,438 $ (28,151) $ 63,936

Amortization of goodwill and acquired workforce-in-place, net of tax benefit of $0, $2,745 and

$1,977, respectively –196,894 70,271

Net income, as adjusted $248,438 $168,743 $134,207

Net income (loss) per share – basic, as reported $1.71 $(0.20) $ 0.49

Amortization of goodwill and acquired workforce-in-place, net of tax benefit –1.38 0.55

Net income per share – basic, as adjusted 1.71 1.18 1.04

Effect of dilutive securities (0.17) (0.08) (0.06)

Net income per share – diluted, as adjusted $1.54 $1.10 $ 0.98

Shares used to compute net income (loss) per share – basic, as adjusted 145,395 143,604 129,474

Shares issuable from assumed conversion of options 7,748 7,593 7,000

Shares issuable from assumed conversion of convertible subordinated notes 17,575 7,580 –

Shares used to compute net income per share – diluted, as adjusted 170,718 158,777 136,474