Symantec 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 Symantec 2003

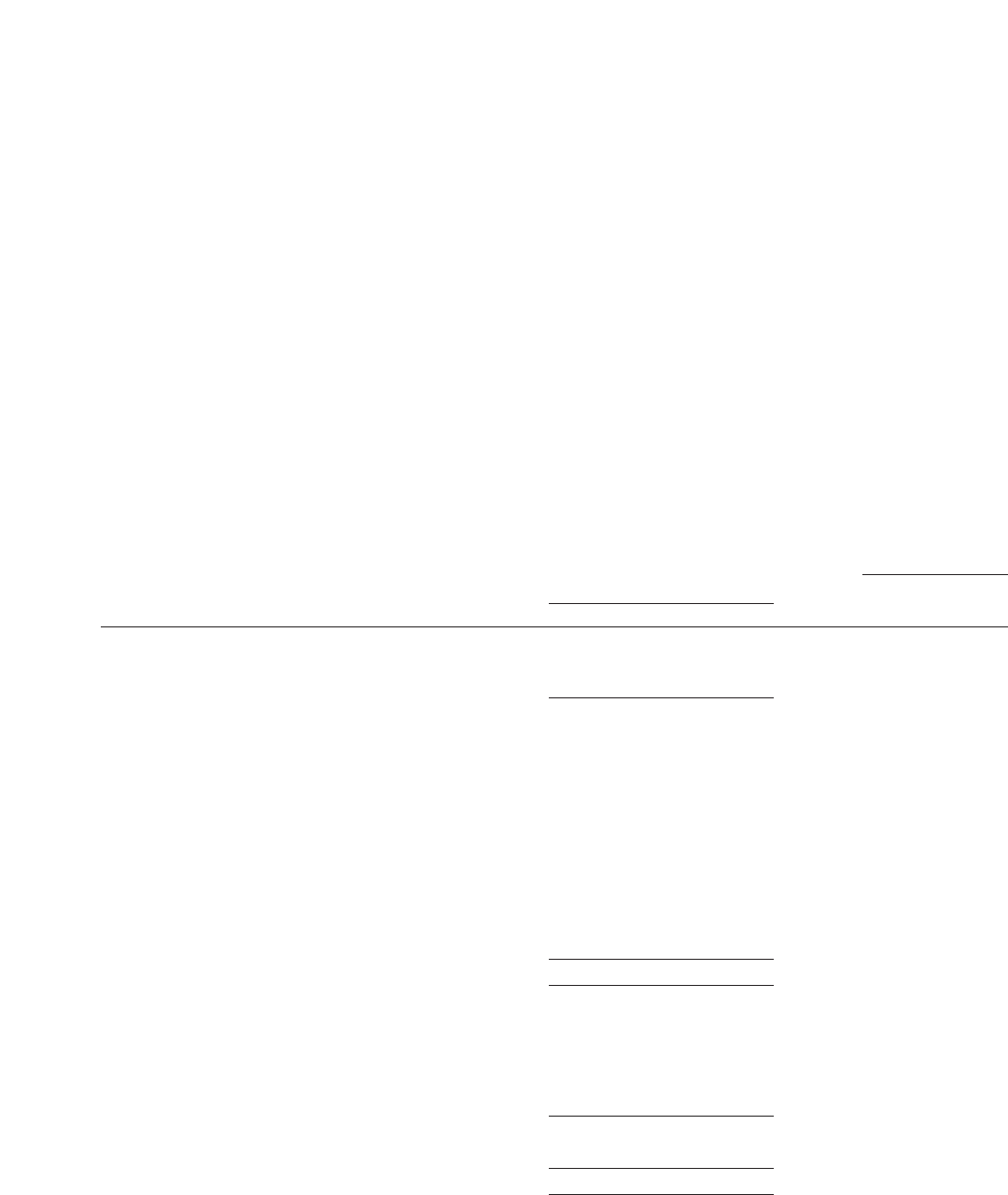

Period-to-Period Percentage

Increase (Decrease)

2003 2002

Year Ended March 31, Compared Compared

2003 2002 2001 to 2002 to 2001

Net revenues 100% 100% 100% 31% 26%

Cost of revenues 18 18 16 28 48

Gross margin 82 82 84 32 21

Operating expenses:

Research and development 14 15 15 20 29

Sales and marketing 38 40 40 23 25

General and administrative 555 3522

Amortization of goodwill –19 8 (100) 176

Amortization of other intangibles from acquisitions ––– **

Acquired in-process research and development ––3 *(100)

Restructuring, site closures and other 12– (46) 458

Litigation judgment ––– **

Total operating expenses 58 81 71 (6) 42

Operating income 24 113 4,147 (93)

Interest income 334 19(5)

Interest expense (1) (1) – 131 *

Income, net of expense, from sale of technologies and product lines –12 (56) (24)

Other expense, net ––(3) – *

Income before income taxes 26 416 699 (68)

Provision for income taxes 879 56(4)

Net income (loss) 18% (3)% 7% 983 (144)

* Percentage change is not meaningful.

RECENT EVENTS

During the September 2002 quarter, we acquired the following four

privately held companies for approximately $375.2 million in cash:

•Riptech, Inc., a provider of scalable, real-time managed security

services that protect clients through advanced outsourced security

monitoring and professional services.

•Recourse Technologies, Inc., a provider of security threat manage-

ment solutions that detect, analyze and respond to both known and

novel threats, including intrusions, internal attacks and denial of

service attacks.

•SecurityFocus Inc., a provider of enterprise security threat manage-

ment systems, providing global early warning of cyber attacks, cus-

tomized and comprehensive threat alerts, and countermeasures to

prevent attacks before they occur.

•Mountain Wave, Inc., a provider of automated attack sensing and

warning software and services for real-time enterprise security

operations management.

As a result of these acquisitions, we recorded, as adjusted for revised

estimates related to certain liabilities, approximately $4.7 million for

acquired in-process research and development, $40.5 million for devel-

oped technology and acquired product rights, $307.5 million for good-

will, $4.3 million for other intangibles, $19.3 million for net deferred tax

assets and $7.6 million for tangible assets, net of liabilities.

Results of Operations

The following table sets forth each item from our consolidated state-

ments of operations as a percentage of net revenues and the percent-

age change in the total amount of each item for the periods indicated.