Supercuts 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

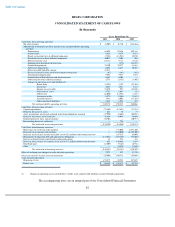

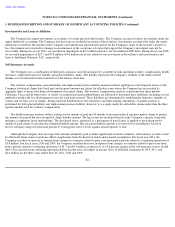

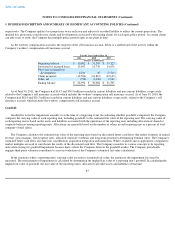

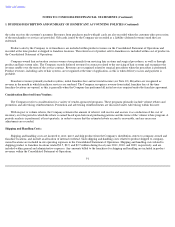

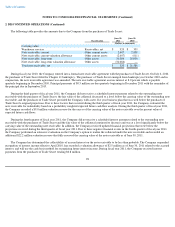

A summary of the Company's goodwill balance as of June 30, 2011 and 2010 by reporting unit is as follows:

As a result of the Company's annual impairment analysis of goodwill during the third quarter of fiscal year 2010, a $35.3 million

impairment charge was recorded within continuing operations for the excess of the carrying value of goodwill over the implied fair value of

goodwill for the Regis salon concept.

As a result of the Company's interim impairment test of goodwill during the three months ended December 31, 2008, a $41.7 million

impairment charge for the full carrying amount of goodwill within the salon concepts in the United Kingdom was recorded within continuing

operations. The recent performance challenges of the international salon operations indicated that the estimated fair value was less than the

current carrying of this reporting unit's net assets, including goodwill.

Long-Lived Asset Impairment Assessments, Excluding Goodwill:

The Company reviews long-lived assets for impairment at the salon level annually or if events or circumstances indicate that the carrying

value of such assets may not be recoverable. The Company's test for impairment of property and equipment is performed at a salon level as this

is the lowest level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities. Impairment

is evaluated based on the sum of undiscounted estimated future cash flows expected to result from use of the assets that does not recover the

carrying value of the related salon assets. When the sum of a salon's undiscounted estimated future cash flow is zero or negative, impairment is

measured as the full carrying value of the related salon's equipment and leasehold improvements. When the sum of a salon's undiscounted cash

flows is greater than zero but less than the carrying value of the related salon's equipment and leasehold improvements, a discounted cash flow

analysis is performed to estimate the fair value of the salon assets and impairment is measured as the difference between the carrying value of

the salon assets and the estimated fair value. The fair value estimate is based on the best information available, including market data.

89

Reporting Unit

As of June 30,

2011

As of June 30,

2010

(Dollars in thousands)

Regis

$

103,761

$

102,180

MasterCuts

4,652

4,652

SmartStyle

48,916

48,280

Supercuts

129,477

121,693

Promenade

240,910

309,804

Total North America Salons

527,716

586,609

Hair Restoration Centers

152,796

150,380

Consolidated Goodwill

$

680,512

$

736,989