Supercuts 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

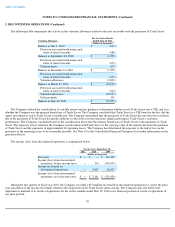

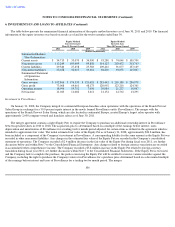

6. INVESTMENTS IN AND LOANS TO AFFILIATES (Continued)

buyout of EEG's minority interest shareholder. EEG operates 102 accredited cosmetology schools, has revenues of approximately $193 million

annually and is overseen by the Empire Beauty School management team.

At June 30, 2011 and 2010, the Company had a $21.4 million outstanding loan receivable with EEG that is due in January 2013. The

Company has also provided EEG with a $15.0 million revolving credit facility, against which there no outstanding borrowings as of June 30,

2011 and 2010. During fiscal year 2011, 2010, and 2009, the Company recorded $0.7, $0.7, and $0.9 million, respectively, of interest income

related to the loan and revolving credit facility. The Company has also guaranteed a credit facility of EEG. The exposure to loss related to the

Company's involvement with EEG is the carrying value of the investment, the outstanding loan and the guarantee of the credit facility.

The Company utilized consolidation of variable interest entities guidance to determine whether or not its investment in EEG was a variable

interest entity (VIE), and if so, whether the Company was the primary beneficiary of the VIE. The Company concluded that EEG was not a VIE

based on the fact that EEG had sufficient equity at risk. As the substantive voting control relates to the voting rights of the Board of Directors,

the Company granted the other shareholder a proxy to vote such number of the Company's shares such that the other shareholder would have

voting control of 51.0 percent of the common stock of EEG. The Company accounts for EEG as an equity investment under the voting interest

model. During fiscal years ended June 30, 2011, 2010, and 2009, the Company recorded $5.5, $6.4, and $2.1 million of equity earnings related to

its investment in EEG. During the twelve months ended June 30, 2011, EEG declared and distributed a dividend in which the Company received

$4.1 million in cash and recorded tax expense of $0.3 million.

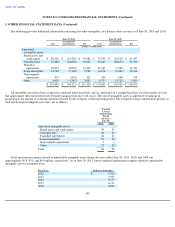

Investment in MY Style

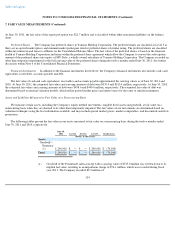

In April 2007, the Company purchased exchangeable notes issued by Yamano Holding Corporation (Exchangeable Note) and a loan

obligation of a Yamano Holdings subsidiary, MY Style, formally known as Beauty Plaza Co. Ltd., (MY Style Note) for an aggregate amount of

$11.3 million (1.3 billion Yen as of April 2007). The Exchangeable Note contains an option for the Company to exchange a portion of the

Exchangeable Note for shares of common stock of MY Style. In connection with the issuance of the Exchangeable Note, the Company paid a

premium of approximately $5.5 million (573,000,000 Yen as of April 2007).

Exchangeable Note. In September 2008, the Company advanced an additional $3.0 million (300,000,000 Yen as of September 2008) to

Yamano Holding Corporation (Yamano). In connection with the 300,000,000 Yen advance, the exchangeable portion of the Exchangeable Note

increased from approximately 14.8 percent to 27.1 percent of the 800 outstanding shares of MY Style for 21,700,000 Yen. This exchange feature

is akin to a deep-in-the-money option permitting the Company to purchase shares of common stock of MY Style. The option is embedded in the

Exchangeable Note and does not meet the criteria for separate accounting under accounting for derivative instruments and hedging activities.

The Company determined that the September 2008 modifications to the Exchangeable Note were more than minor and the loan

modification should be treated as an extinguishment. The Company recorded a $2.1 million (224,000,000 Yen as of September 2008) gain

related to the modification of the Exchangeable Note. However, based upon the overall fair value of the Exchangeable Note on the date of

modification, the Company recorded an other than temporary impairment loss of $3.4 million (370,000,000 Yen as of September 2008). The

$1.3 million net amount of the gain and other than

109