Supercuts 2011 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

15. SHAREHOLDERS' EQUITY (Continued)

annually on each of the first five anniversaries of the date of grant. The stock options and SARs have a maximum term of ten years. The cash-

based performance grants will be tied to the achievement of certain performance goals during a specified performance period, not less than one

fiscal year in length. The RSUs cliff vest after five years and payment of the RSUs is deferred until January 31 of the year following vesting.

Unvested awards are subject to forfeiture in the event of termination of employment. See Note 1 to the Consolidated Financial Statements for

discussion of the Company's measure of compensation cost for its incentive stock plans, as well as an estimate of future compensation expense

related to these awards.

The Company also has outstanding stock options under the 2000 Stock Option Plan (2000 Plan), although the plan terminated in 2010,

which allowed the Company to grant both incentive and nonqualified stock options and replaced the Company's 1991 Stock Option Plan (1991

Plan). Total options covering 3,500,000 shares of common stock were available for grant under the 2000 Plan to employees of the Company for

a term not to exceed ten years from the date of grant. The term may not exceed five years for incentive stock options granted to employees of the

Company possessing more than ten percent of the total combined voting power of all classes of stock of the Company or any subsidiary of the

Company. Options may also be granted to the Company's outside directors for a term not to exceed ten years from the grant date. The 2000 Plan

contains restrictions on transferability, time of exercise, exercise price and on disposition of any shares acquired through exercise of the options.

Stock options were granted at not less than fair market value on the date of grant. The Board of Directors determines the 2000 Plan participants

and establishes the terms and conditions of each option.

The terms and conditions of the shares granted under the 1991 Plan are similar to the 2000 Plan. The 1991 Plan terminated in 2001. All

shares granted under the 1991 Plan have been exercised, forfeited, or cancelled as of June 30, 2011.

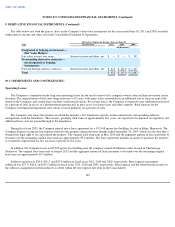

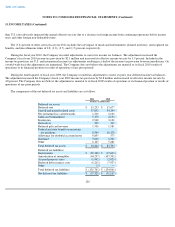

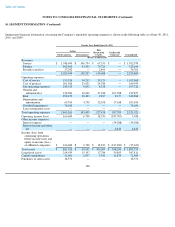

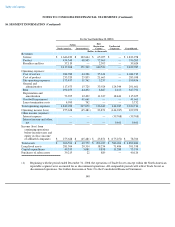

Common shares available for grant under the following plans as of June 30 were:

132

2011

2010

2009

(Shares in thousands)

2000 Plan

—

4

268

2004 Plan

4,209

12

103

4,209

16

371