Supercuts 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Contingencies

We are involved in various lawsuits and claims that arise from time to time in the ordinary course of our business. Accruals are recorded for

such contingencies based on our assessment that the occurrence is probable, and where determinable, an estimate of the liability amount.

Management considers many factors in making these assessments including past history and the specifics of each case. However, litigation is

inherently unpredictable and excessive verdicts do occur, which could have a material impact on our Consolidated Financial Statements.

During fiscal year 2011, the Company settled a legal claim with the former owner of Hair Club for $1.7 million.

During fiscal year 2010, the Company settled two legal claims regarding certain customer and employee matters for an aggregate charge of

$5.2 million plus a commitment to provide discount coupons. During the twelve months ended June 30, 2011, the final payments aggregating

$4.3 million were made.

OVERVIEW OF FISCAL YEAR 2011 RESULTS

The following summarizes key aspects of our fiscal year 2011 results:

•

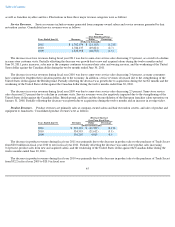

Revenues decreased 1.4 percent to $2.3 billion during fiscal year 2011. The Company experienced a decline in customer visitation

partially offset by an increase in average ticket price, resulting in a decrease in consolidated same-

store sales of 1.7 percent. Fiscal

year 2010 revenues included a one-time sale of $20.0 million of product to the purchaser of Trade Secret.

•

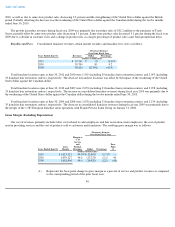

The Company recorded a goodwill impairment charge of $74.1 million associated with our Promenade salon concept during fiscal

year 2011.

•

Long

-

lived asset impairment charges of $6.7 million were recorded during fiscal year 2011.

•

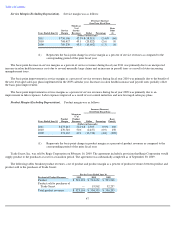

The Company recorded a $31.2 million valuation reserve on the note receivable with the purchaser of Trade Secret.

• During fiscal year 2011, the Company settled a legal claim with the former owner of Hair Club for $1.7 million.

•

The Company recorded a $9.2 million other than temporary impairment on its investment in preferred shares of Yamano Holdings

Corporation and premium paid on an investment with a subsidiary of Yamano Holdings Corporation.

• Upon the March 2011 acquisition of the approximately 17 percent additional ownership interest in Provalliance, the Company

recognized a net gain of approximately $2.4 million representing the settlement of a portion of the company's equity put liability

and additional ownership of the Frank Provost Group in Provalliance.

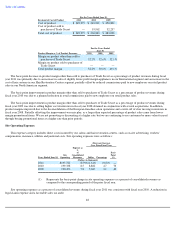

• Total debt at the end of fiscal year 2011 declined to $313.4 million and our debt-to-capitalization ratio, calculated as total debt as

a percentage of total debt and shareholders' equity at fiscal year end, improved 700 basis points to 23.3 percent as compared to

June 30, 2010. The decrease in debt-to-capitalization ratio from fiscal year 2010 to fiscal year 2011 was primarily due to the

repayment of an $85.0 million term loan during fiscal year 2011 and foreign currency translation adjustments due to the

weakening of the United States dollar against the Canadian dollar and British pound.

•

The annual effective income tax rate of 37.1 percent was impacted by employment credits related to the Small Business and Work

Opportunity Tax Act of 2007 which benefited the effective income tax rate by 15.3 percent. Based upon current legislation these

credits are

41