Supercuts 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

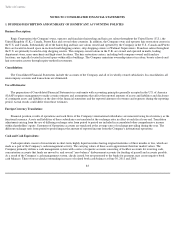

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

is determined by applying estimated gross profit margins to service revenues. The estimated gross profit margins related to service inventories

are updated semi-annually based on the results of the physical inventory counts and other factors that could impact the Company's margin rate

estimates such as mix of service sales, discounting and special promotions. Actual results for the estimated gross margin percentage as compared

to the semi-annual estimates have not historically resulted in material adjustments to our Statement of Operations.

Property and Equipment:

Property and equipment are carried at cost, less accumulated depreciation and amortization. Depreciation and amortization of property and

equipment are computed on the straight-line method over estimated useful asset lives (30 to 39 years for buildings, 10 years for improvements

and three to ten years for equipment, furniture and software). Depreciation expense was $88.6, $92.5, and $105.1 million in fiscal years 2011,

2010, and 2009, respectively. Leasehold improvements are amortized over the shorter of their estimated useful lives or the related lease term,

generally ten years. For leases with renewal periods at the Company's option, management may determine at the inception of the lease that

renewal is reasonably assured if failure to exercise a renewal option imposes an economic penalty to the Company. In such cases, the Company

will include the renewal option period along with the original lease term in the determination of appropriate estimated useful lives.

The Company capitalizes both internal and external costs of developing or obtaining computer software for internal use. Costs incurred to

develop internal-use software during the application development stage are capitalized, while data conversion, training and maintenance costs

associated with internal-use software are expensed as incurred. At June 30, 2011 and 2010, the net book value of capitalized software costs was

$34.1 and $35.2 million, respectively. Amortization expense related to capitalized software was $8.4, $8.5, and $9.1 million in fiscal years 2011,

2010, and 2009, respectively, which has been determined based on an estimated useful life of five or seven years.

Historically, because of the Company's large size and scale requirements it has been necessary for the Company to internally develop and

support its own proprietary POS information system. The Company has recently identified a third party POS alternative that has a system that

meets our current and enhanced functionality requirements and will cost significantly less to implement and support. Due to the Company's plan

to replace the POS information system, the Company reviewed the capitalized software carrying value for impairment at June 30, 2011. As a

result of the Company's long-lived asset impairment testing at June 30, 2011 for this grouping of assets, no impairment charges were recorded.

The Company has reassessed and adjusted the useful life of the capitalized software as the POS alternative is expected be implemented in salons

during the first half of fiscal year 2012. The Company expects to fully amortize the net balance of the existing POS information system,

approximately $20 million at June 30, 2011, during fiscal year 2012 as locations using the Company's existing POS information system move to

a third party POS alternative.

Expenditures for maintenance and repairs and minor renewals and betterments which do not improve or extend the life of the respective

assets are expensed. All other expenditures for renewals and betterments are capitalized. The assets and related depreciation and amortization

accounts are adjusted for property retirements and disposals with the resulting gain or loss included in operating income. Fully depreciated or

amortized assets remain in the accounts until retired from service.

85