Supercuts 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

sites which allow customers adequate parking and quick and easy location access. Various other factors are considered in evaluating

sites, including area demographics, availability and cost of space, the strength of the major retailers within the area, location and strength

of competitors, proximity of other company-owned and franchise salons, traffic volume, signage and other leasehold factors in a given

center or area.

Because the Company's various salon concepts target slightly different mass market customer groups, more than one of the

Company's salon concepts may be located in the same real estate development without impeding sales of either concept. As a result, there

are numerous leasing opportunities for all of its salon concepts.

While same-store sales growth plays an important role in the Company's organic growth strategy, it is not critical to achieving the

Company's long-term revenue growth objectives. However, same-

store sales growth is important to achieving improved annual operating

profit. New salon construction and salon acquisitions (described below) are expected to generate low single-digit annual revenue growth.

The recent trend has been slowly improving visitation patterns and marginal increases in average ticket price resulting in negative to low

single-digit same-store sales growth. The Company expects fiscal year 2012 same-store sales to be in the range of negative 1.0 percent to

positive 1.0 percent.

Pricing is a factor in same-store sales growth. The Company actively monitors the prices charged by its competitors in each market

and makes every effort to maintain prices which remain competitive with prices of other salons offering similar services. Price increases

are considered on a market-by-market basis and are established based on local market conditions.

Salon Acquisition Growth. In addition to organic growth, another key component of the Company's growth strategy is the

acquisition of salons. With an estimated two percent worldwide market share, management believes the opportunity to continue to make

selective acquisitions exists.

Over the past 17 years, the Company has acquired 8,050 salons, expanding both in North America and internationally. When

contemplating an acquisition, the Company evaluates the existing salon or salon group with respect to the same characteristics as

discussed above in conjunction with site selection for constructed salons (conveniently located, visible, strong retailers within the area,

etc.). The Company generally acquires mature strip center locations, which are systematically integrated within the salon concept that it

most clearly emulates.

In addition to adding new salon locations each year, the Company has an ongoing program of remodeling its existing salons, ranging

from redecoration to substantial reconstruction. This program is implemented as management determines that a particular location will

benefit from remodeling, or as required by lease renewals. A total of 271 and 333 salons had major remodels in fiscal years 2011 and

2010, respectively.

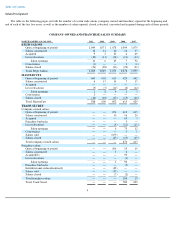

Recent Salon Additions. During fiscal year 2011, the Company constructed 213 new salons (146 company-owned and

67 franchise). Additionally, the Company acquired 105 company-owned salons, including 78 franchise salon buybacks.

During fiscal year 2010, the Company constructed 217 new salons (139 company-owned and 78 franchise). Additionally, the

Company acquired 26 company-owned salons, including 23 franchise salon buybacks.

Salon Closures. The Company evaluates its salon performance on a regular basis. Upon evaluation, the Company may close a

salon for operational performance or real estate issues. In either case, the closures generally occur at the end of a lease term and typically

do not require significant lease buyouts.

6