Supercuts 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. BUSINESS DESCRIPTION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

respectively. The Company updates loss projections twice each year and adjusts its recorded liability to reflect the current projections. The

updated loss projections consider new claims and developments associated with existing claims for each open policy period. As certain claims

can take years to settle, the Company has multiple policy periods open at any point in time.

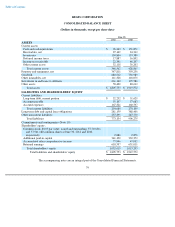

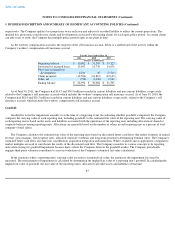

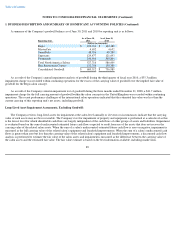

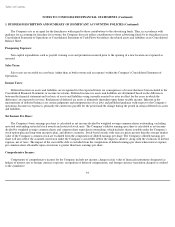

As the workers' compensation accrual is the majority of the self insurance accrual, below is a rollforward of the activity within the

Company's workers' compensation self insurance accrual:

As of June 30, 2011, the Company had $14.7 and $30.9 million recorded in current liabilities and non-current liabilities, respectively,

related to the Company's self insurance accruals which includes the workers' compensation self insurance accrual. As of June 30, 2010, the

Company had $18.4 and $26.5 million recorded in current liabilities and non-current liabilities, respectively, related to the Company's self

insurance accruals which includes the workers' compensation self insurance accrual.

Goodwill:

Goodwill is tested for impairment annually or at the time of a triggering event. In evaluating whether goodwill is impaired, the Company

compares the carrying value of each reporting unit, including goodwill, to the estimated fair value of the reporting unit. The carrying value of

each reporting unit is based on the assets and liabilities associated with the operations of the reporting unit, including allocation of shared or

corporate balances among reporting units. Allocations are generally based on the number of salons in each reporting unit as a percent of total

company-owned salons.

The Company calculates the estimated fair value of the reporting units based on discounted future cash flows that utilize estimates in annual

revenue, gross margins, fixed expense rates, allocated corporate overhead, and long-term growth for determining terminal value. The Company's

estimated future cash flows also take into consideration acquisition integration and maturation. Where available and as appropriate, comparative

market multiples are used to corroborate the results of the discounted cash flow. The Company considers its various concepts to be reporting

units when testing for goodwill impairment because that is where the Company believes the goodwill resides. The Company periodically

engages third-party valuation consultants to assist in evaluation of the Company's estimated fair value calculations.

In the situations where a reporting unit's carrying value exceeds its estimated fair value, the amount of the impairment loss must be

measured. The measurement of impairment is calculated by determining the implied fair value of a reporting unit's goodwill. In calculating the

implied fair value of goodwill, the fair value of the reporting unit is allocated to all other assets and liabilities of that unit

87

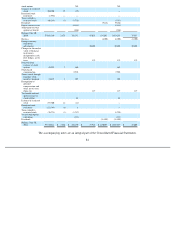

For the Years Ended June 30,

2011

2010

2009

(Dollars in thousands)

Beginning balance

$

30,082

$

31,505

$

35,123

Provision for incurred losses

13,993

14,739

14,676

Prior year actuarial loss

development

2,231

35

(7,715

)

Claim payments

(12,584

)

(14,867

)

(12,145

)

Other, net

(728

)

(1,330

)

1,566

Ending balance

$

32,994

$

30,082

$

31,505