Supercuts 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

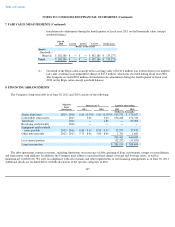

8. FINANCING ARRANGEMENTS (Continued)

of varying maturities and $30.0 million of additional senior term notes under a Private Shelf Agreement.

As a result of the repayment of a portion of the senior term notes during the twelve months ended June 30, 2010, the Company incurred

$12.8 million in make-whole payments and other fees along with $5.2 million in interest rate swap settlements, as discussed in Note 9 of the

Consolidated Financial Statements, totaling $18.0 million that was recorded as interest expense within the Consolidated Statement of Operations.

Convertible Senior Notes

In July 2009, the Company issued $172.5 million aggregate principal amount of 5.0 percent convertible senior notes due July 2014. The

notes are unsecured, senior obligations of the Company and interest will be payable semi-annually in arrears on January 15 and July 15 of each

year at a rate of 5.0 percent per year. The notes will be convertible subject to certain conditions further described below at an initial conversion

rate of 64.6726 shares of the Company's common stock per $1,000 principal amount of notes (representing an initial conversion price of

approximately $15.46 per share of the Company's common stock). As of June 30, 2011, the conversion rate was 64.8263 shares of the

Company's common stock per $1,000 principal amount of notes (representing a conversion price of approximately $15.43 per share of the

Company's common stock).

Holders may convert their notes at their option prior to April 15, 2014 if the Company's stock price meets certain price triggers or upon the

occurrence of specified corporate events as defined in the convertible senior note agreement. On or after April 15, 2014, holders may convert

each of their notes at their option at any time prior to the maturity date for the notes.

The Company has the choice of net-cash settlement, settlement in its own shares or a combination thereof and concluded the conversion

option is indexed to its own stock. As a result, in July 2009 the Company allocated $24.7 million of the $172.5 million principal amount of the

convertible senior notes to equity, which resulted in a $24.7 million debt discount. The allocation was based on measuring the fair value of the

convertible senior notes using a discounted cash flow analysis. The discount rate was based on an estimated credit rating for the Company. In

July 2009, the estimated fair value of the convertible senior notes was $147.8 million. The resulting $24.7 million debt discount will be

amortized over the period the convertible senior notes are expected to be outstanding, which is five years, as additional non-cash interest

expense. The combined debt discount amortization and the contractual interest coupon resulted in an effective interest rate on the convertible

debt of 8.9 percent.

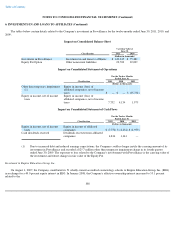

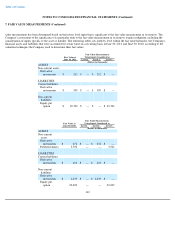

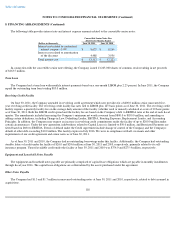

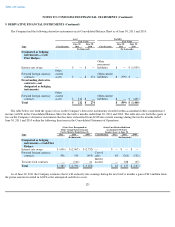

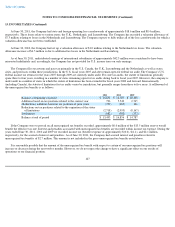

The following table provides equity and debt information for the convertible senior notes:

117

Convertible Senior Notes

Due 2014 at

(Dollars in thousands)

June 30, 2011

June 30, 2010

Principal amount on the convertible

senior notes

$

172,500

$

172,500

Unamortized debt discount

(16,252

)

(20,740

)

Net carrying amount of convertible

debt

$

156,248

$

151,760